North America : Leading Market Innovators

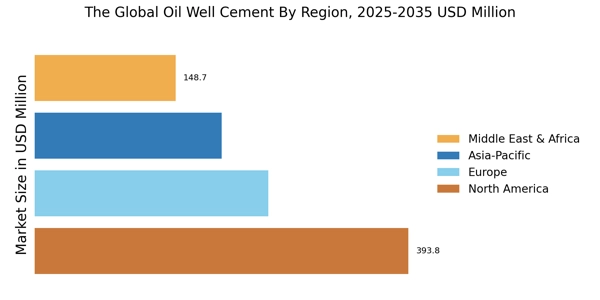

North America is the largest market for oil well cement, accounting for approximately 40% of the global share. The region's growth is driven by increasing drilling activities, technological advancements, and stringent regulations promoting safety and environmental standards. The demand for high-performance cement solutions is also on the rise, fueled by the need for enhanced well integrity and longevity. The United States and Canada are the leading countries in this market, with major players like Halliburton, Schlumberger, and Baker Hughes dominating the landscape.

Activity in the Canada oil well cement market is largely sustained by the ongoing development of unconventional resources and the specialized requirements of cold-climate drilling operations.

The competitive environment is characterized by continuous innovation and strategic partnerships among key players, ensuring a robust supply chain and meeting the evolving needs of the oil and gas industry.

Europe : Regulatory-Driven Market Dynamics

The Europe oil well cement market is increasingly influenced by stringent environmental regulations, driving the adoption of low-carbon cement blends for North Sea offshore projects. Having witnessed a significant growth in the oil well cement market, this region is holding approximately 25% of the global share. The region's expansion is largely driven by regulatory frameworks aimed at promoting sustainable practices and reducing environmental impact. Countries are increasingly adopting advanced cement technologies to meet stringent EU regulations, which is expected to further boost market demand in the coming years. Leading countries in this region include Germany, France, and the UK, where major companies like Total and LafargeHolcim are actively involved. In this region, the UK oil well cement market is shifting its focus toward well abandonment and decommissioning services as mature fields in the region reach the end of their production life.

The market is also supported by collaborations between industry stakeholders and regulatory bodies.

Asia-Pacific : Emerging Market Potential

Expansion in the APAC Oil Well Cement Market is primarily fueled by rising energy consumption and the intensification of both onshore and offshore drilling activities in emerging economies This region is emerging as a significant player in the oil well cement market, accounting for approximately 20% of the global share. The region's growth is driven by increasing energy demands, particularly in countries like China and India, where rapid industrialization and urbanization are leading to heightened drilling activities.

Additionally, favorable government policies and investments in infrastructure are catalyzing market expansion. China and India are the leading countries in this region, with a growing presence of key players such as National Oilwell Varco and FLSmidth. Rising domestic production targets are stimulating the India Oil Well Cement Market, leading to increased procurement of API-certified cement for new exploration blocks.

The competitive landscape is evolving, with local manufacturers gaining traction alongside established global companies. The market is characterized by a focus on cost-effective solutions and the adoption of advanced technologies to enhance cement performance and reliability, catering to the unique challenges of the region.

Middle East and Africa : Resource-Rich Market Landscape

The Middle East and Africa region is witnessing a burgeoning oil well cement market, holding approximately 15% of the global share. The growth is primarily driven by the region's vast oil reserves and ongoing exploration activities. Countries are increasingly investing in cement technologies to enhance well integrity and meet the demands of challenging drilling environments, supported by favorable government policies and international partnerships. Leading countries in this region include Saudi Arabia, UAE, and South Africa, where key players like Cementation and Sika are making significant inroads. The competitive landscape is characterized by a mix of local and international companies, with a focus on innovation and sustainability. The market is expected to grow as investments in oil and gas infrastructure continue to rise, creating opportunities for cement manufacturers.