Tonic Water Market Summary

As per Market Research Future analysis, the Tonic Water Market Size was estimated at 2.254 USD Billion in 2024. The Tonic Water industry is projected to grow from USD 2.522 Billion in 2025 to USD 7.763 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.9% during the forecast period 2025 - 2035, driven by evolving tonic water market trends across regions.

Key Market Trends & Highlights

The tonic water market is experiencing a dynamic shift towards health-conscious and premium offerings.

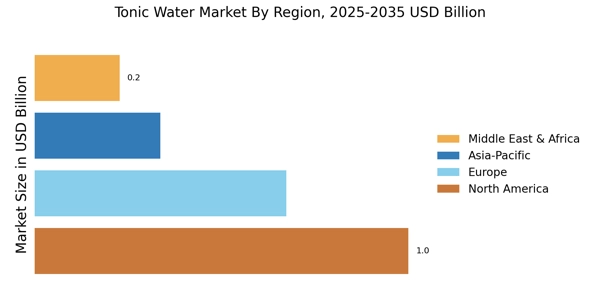

- North America remains the largest market for tonic water, driven by a growing demand for premium and flavored options.

- The Asia-Pacific region is emerging as the fastest-growing market, reflecting a rising interest in craft cocktails and innovative flavors.

- Flavored tonic water dominates the market, while non-flavored varieties are witnessing rapid growth due to changing consumer preferences.

- Health-conscious choices and the craft cocktail culture are key drivers propelling the tonic water market forward.

Market Size & Forecast

| 2024 Market Size | 2.254 (USD Billion) |

| 2035 Market Size | 7.763 (USD Billion) |

| CAGR (2025 - 2035) | 11.9% |

Major Players

Fever-Tree (GB), Schweppes (GB), Q Mixers (US), Canada Dry (CA), Fentimans (GB), Tonic Water (US), East Imperial (NZ), Thomas Henry (DE)