Consumer Preferences

Consumer preferences are shifting towards sustainable and high-quality packaging solutions, significantly impacting the Tinplate Market. As awareness of environmental issues grows, consumers are increasingly favoring products that utilize recyclable materials. In 2025, it is anticipated that the demand for tinplate packaging will rise, driven by its recyclability and durability. This shift in consumer behavior is prompting manufacturers to enhance their product offerings, focusing on aesthetics and functionality. The trend towards premium packaging in sectors such as food and beverages is likely to further bolster the tinplate market, as brands seek to differentiate themselves. Understanding and adapting to these evolving consumer preferences will be crucial for companies aiming to thrive in the competitive landscape of the Tinplate Market.

Regulatory Compliance

Regulatory compliance is becoming a pivotal driver in the Tinplate Market, as governments worldwide implement stricter packaging regulations. These regulations often focus on reducing waste and promoting recycling, which aligns with the inherent properties of tinplate. In 2025, compliance with these regulations is expected to influence purchasing decisions among manufacturers and consumers alike. Companies that prioritize compliance are likely to gain a competitive edge, as they can market their products as environmentally responsible. Furthermore, adherence to safety standards in food packaging is critical, as it ensures consumer protection and enhances brand trust. The evolving regulatory landscape may compel companies to innovate and invest in sustainable practices, thereby shaping the future of the Tinplate Market.

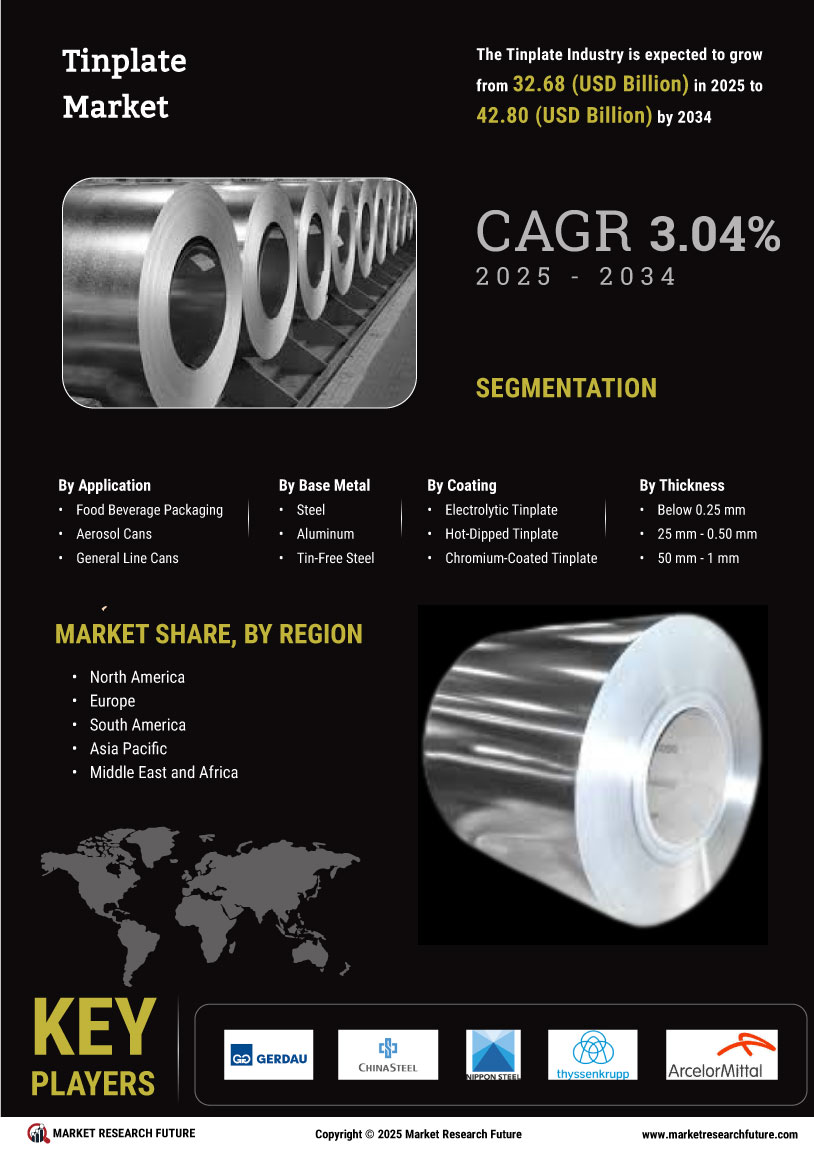

Emerging Market Growth

Emerging markets are becoming increasingly significant for the Tinplate Market, as economic development and urbanization drive demand for packaged goods. Countries in Asia and Africa are witnessing rapid population growth and rising disposable incomes, leading to a surge in consumer spending. In 2025, the tinplate packaging segment is projected to expand significantly in these regions, with an estimated growth rate of 5% annually. This growth is fueled by the increasing preference for convenient and durable packaging solutions in sectors such as food, beverages, and personal care. As manufacturers seek to penetrate these markets, they are likely to adapt their product offerings to cater to local preferences, thereby enhancing their market presence. The potential for growth in emerging markets presents a lucrative opportunity for stakeholders in the Tinplate Market.

Sustainability Initiatives

The Tinplate Market is experiencing a notable shift towards sustainability initiatives. As consumers increasingly demand environmentally friendly packaging solutions, manufacturers are adapting their production processes to meet these expectations. The use of tinplate, which is recyclable and has a lower carbon footprint compared to alternatives, positions the industry favorably. In 2025, the market is projected to grow at a compound annual growth rate of approximately 4.5%, driven by the rising emphasis on sustainable practices. Companies are investing in eco-friendly technologies and materials, which not only enhance their brand image but also comply with stringent regulations. This trend indicates a long-term commitment to sustainability, potentially reshaping the competitive landscape of the Tinplate Market.

Technological Advancements

Technological advancements are playing a crucial role in the evolution of the Tinplate Market. Innovations in manufacturing processes, such as improved coating technologies and automated production lines, are enhancing efficiency and product quality. These advancements allow for the production of thinner, lighter tinplate, which reduces material costs and waste. In 2025, the industry is expected to witness a surge in demand for high-performance tinplate products, particularly in the food and beverage sector. The integration of smart technologies, such as IoT and AI, into production facilities is likely to optimize operations and reduce downtime. This technological evolution not only boosts productivity but also aligns with the industry's sustainability goals, indicating a promising future for the Tinplate Market.