Thiochemical Size

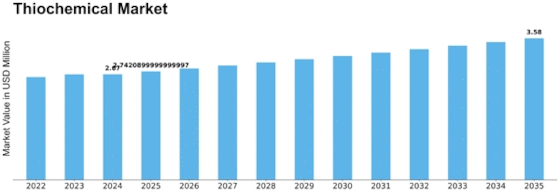

Thiochemical Market Growth Projections and Opportunities

The thiochemical market is influenced by various market factors that shape its demand, supply, and overall industry dynamics

Chemical Industry Growth: The thiochemical market's demand is closely tied to the overall growth of the chemical industry. Thiochemicals, including products such as hydrogen sulfide, sulfuric acid, and thiol compounds, serve as essential intermediates in the production of various chemicals, including fertilizers, detergents, pharmaceuticals, and pesticides. As the chemical industry expands to meet the growing demand for these end products, the demand for thiochemicals increases accordingly.

Fertilizer Production: The fertilizer industry represents a major consumer of thiochemicals, particularly sulfuric acid, which is used in the production of phosphate and ammonium sulfate fertilizers. Sulfuric acid serves as a key raw material in the manufacturing process, where it is used for neutralization, acidulation, and pH adjustment. With the increasing global demand for fertilizers to support agricultural productivity and food security, the demand for thiochemicals in fertilizer production is expected to grow.

Mining and Metallurgy: Thiochemicals are utilized in the mining and metallurgy industry for various applications such as ore leaching, metal extraction, and wastewater treatment. Compounds like hydrogen sulfide and thiol collectors are used in mineral processing operations to facilitate the extraction of metals from ores. Additionally, sulfuric acid is employed in metallurgical processes such as smelting, refining, and pickling. As the demand for metals such as copper, nickel, and gold continues to rise, the demand for thiochemicals in mining and metallurgy is expected to increase.

Water Treatment: Thiochemicals play a crucial role in water treatment applications, where they are utilized for odor control, disinfection, and wastewater treatment. Hydrogen sulfide is commonly found in wastewater streams and industrial effluents and must be removed to comply with environmental regulations. Thiochemicals such as sodium sulfide and sodium hydrosulfide are used as reducing agents and odor control agents in water treatment processes. With growing concerns over water pollution and the need for clean water supplies, the demand for thiochemicals in water treatment is anticipated to grow.

Pulp and Paper Industry: The pulp and paper industry utilizes thiochemicals in various stages of the papermaking process, including pulp bleaching, pitch control, and black liquor recovery. Thiochemicals such as sodium hydrosulfide and sodium sulfide are used in the bleaching of pulp to remove lignin and achieve the desired brightness in paper products. Additionally, sulfuric acid is employed in the digestion and recovery of chemicals from black liquor in the kraft pulping process. As demand for paper products remains steady and the industry focuses on sustainability, the demand for thiochemicals in pulp and paper manufacturing is expected to continue.

Oil and Gas Sector: Thiochemicals find extensive applications in the oil and gas industry, particularly in sour gas treatment, oil refining, and petrochemical production. Hydrogen sulfide removal is a critical process in natural gas processing facilities and refineries to ensure product quality and safety. Thiochemicals such as amine-based solvents, scavengers, and catalysts are used for gas sweetening, sulfur recovery, and hydrodesulfurization. With the growing demand for energy and petrochemical products, the demand for thiochemicals in the oil and gas sector is projected to rise.

Personal Care and Pharmaceuticals: Thiochemicals are utilized in the personal care and pharmaceutical industries for various applications such as cosmetic formulations, pharmaceutical synthesis, and active pharmaceutical ingredients (APIs). Thiol compounds are used as fragrance ingredients, antioxidants, and skin-conditioning agents in cosmetic products. Additionally, thiochemicals are employed as intermediates in the synthesis of pharmaceuticals such as antibiotics, antifungals, and cardiovascular drugs. As the demand for personal care products and pharmaceuticals continues to grow, the demand for thiochemicals in these industries is expected to increase.

Regulatory Compliance: Regulatory standards and environmental regulations governing the use and handling of thiochemicals impact market dynamics. Compliance with regulations such as OSHA standards, EPA regulations, and REACH directives is essential for thiochemical manufacturers and users to ensure workplace safety and environmental protection. Adherence to regulatory requirements contributes to market credibility, risk mitigation, and sustainable business practices in the thiochemical industry.

Technological Advancements: Technological advancements in thiochemical production processes, catalysts, and purification techniques influence market trends and product innovation. Manufacturers are investing in research and development to improve process efficiency, product quality, and environmental performance. Technological innovations contribute to the development of advanced thiochemical products with enhanced properties such as purity, stability, and reactivity, driving market growth and competitiveness.

Market Competition and Industry Consolidation: Market competition among thiochemical manufacturers and suppliers influences market dynamics and pricing strategies. Industry consolidation, mergers, and acquisitions contribute to market consolidation and competitive positioning in the thiochemical market. Established players and multinational corporations dominate the thiochemical market, while new entrants and regional players focus on niche markets and specialized applications to gain market share and competitive advantage.

Leave a Comment