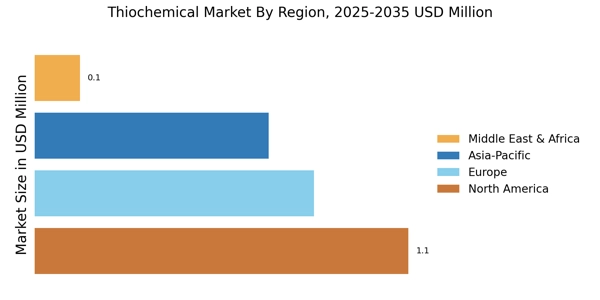

Expansion in Emerging Markets

Emerging markets are becoming increasingly important for the Thiochemical Market, as economic growth in these regions leads to heightened industrial activity. Countries in Asia and Latin America are witnessing a surge in demand for thiochemicals, particularly in sectors such as construction and automotive. This trend is supported by the rising middle class and increased investment in infrastructure projects, which are expected to drive the consumption of thiochemicals. The market in these regions is projected to grow at a rate of approximately 6% annually, highlighting the potential for expansion and the strategic importance of these markets for the Thiochemical Market.

Rising Demand for Specialty Chemicals

The Thiochemical Market is experiencing a notable increase in demand for specialty chemicals, driven by their unique properties and applications across various sectors. Industries such as agriculture, pharmaceuticals, and personal care are increasingly utilizing thiochemicals for their effectiveness in enhancing product performance. For instance, the agricultural sector employs thiochemicals as effective crop protection agents, which has led to a projected growth rate of approximately 5% annually in this segment. This rising demand is indicative of a broader trend towards the use of specialized chemicals that offer tailored solutions, thereby propelling the Thiochemical Market forward.

Regulatory Support for Green Chemistry

Regulatory frameworks are increasingly favoring the adoption of green chemistry principles, which significantly impacts the Thiochemical Market. Governments are implementing policies that encourage the use of environmentally friendly chemicals, thereby promoting the development of thiochemicals that are less harmful to the environment. This shift is expected to drive innovation within the industry, as companies strive to meet these regulatory standards while also catering to consumer preferences for sustainable products. The market for thiochemicals is projected to expand as a result, with an anticipated growth rate of around 4% over the next few years, reflecting the industry's adaptation to these regulatory changes.

Increased Focus on Health and Safety Standards

The Thiochemical Market is witnessing an increased emphasis on health and safety standards, which is driving the demand for safer thiochemical products. As industries become more aware of the potential hazards associated with chemical exposure, there is a growing need for thiochemicals that meet stringent safety regulations. This trend is particularly evident in the pharmaceutical and food sectors, where compliance with health standards is paramount. The market is likely to see a shift towards the development of thiochemicals that not only perform effectively but also adhere to these safety requirements. This focus on health and safety is expected to propel the Thiochemical Market, with a projected growth rate of approximately 4% in the near future.

Technological Innovations in Production Processes

Technological advancements in production processes are playing a crucial role in shaping the Thiochemical Market. Innovations such as continuous flow chemistry and biotechnological methods are enhancing the efficiency and sustainability of thiochemical production. These technologies not only reduce production costs but also minimize waste and energy consumption, aligning with the industry's shift towards more sustainable practices. As a result, companies that adopt these technologies are likely to gain a competitive edge, potentially increasing their market share. The overall impact of these innovations is expected to contribute to a growth rate of around 5% in the Thiochemical Market over the coming years.