Rising Demand from the Automotive Sector

The automotive industry is increasingly adopting tetrafluoroethane as a refrigerant in vehicle air conditioning systems, significantly impacting the Tetrafluoroethane Refrigerant Market. As vehicle manufacturers strive to meet stringent emissions regulations and improve fuel efficiency, the demand for efficient refrigerants is surging. Tetrafluoroethane is favored for its low toxicity and effective cooling properties, making it suitable for automotive applications. Market analysis reveals that the automotive sector accounts for a substantial share of the refrigerant market, with projections indicating a steady growth rate. This trend underscores the importance of the automotive industry in driving the demand for tetrafluoroethane, thereby shaping the overall dynamics of the Tetrafluoroethane Refrigerant Market.

Regulatory Compliance and Environmental Standards

The Tetrafluoroethane Refrigerant Market is currently influenced by stringent regulatory frameworks aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that promote the use of refrigerants with lower global warming potential. As a result, manufacturers are compelled to adapt their product lines to comply with these regulations. The phase-out of high-GWP refrigerants is driving the demand for alternatives like tetrafluoroethane, which is perceived as a more environmentally friendly option. This shift not only aligns with regulatory compliance but also enhances the market's appeal to environmentally conscious consumers. The market is projected to grow as companies invest in research and development to innovate compliant refrigerants, thereby expanding their market share in the Tetrafluoroethane Refrigerant Market.

Technological Innovations in Refrigeration Systems

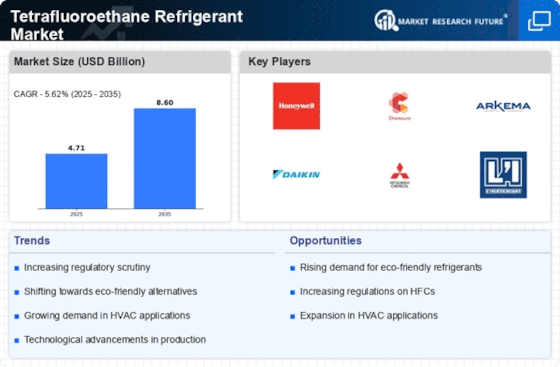

Technological advancements are playing a pivotal role in shaping the Tetrafluoroethane Refrigerant Market. Innovations in refrigeration systems, such as improved energy efficiency and enhanced cooling performance, are driving the adoption of tetrafluoroethane as a preferred refrigerant. The integration of smart technologies in HVAC systems is also contributing to this trend, as these systems require refrigerants that can operate efficiently under varying conditions. Market data indicates that the demand for energy-efficient refrigeration solutions is on the rise, with a projected CAGR of over 5% in the coming years. This trend suggests that manufacturers who invest in advanced technologies will likely gain a competitive edge in the Tetrafluoroethane Refrigerant Market.

Consumer Awareness and Preference for Eco-Friendly Products

There is a growing consumer awareness regarding environmental issues, which is influencing purchasing decisions in the Tetrafluoroethane Refrigerant Market. As consumers become more informed about the impact of refrigerants on climate change, they are increasingly favoring products that are marketed as environmentally friendly. Tetrafluoroethane, with its lower global warming potential compared to traditional refrigerants, is gaining traction among consumers who prioritize sustainability. This shift in consumer preference is prompting manufacturers to highlight the eco-friendly attributes of their products, thereby enhancing their market positioning. The increasing demand for sustainable solutions is expected to drive growth in the Tetrafluoroethane Refrigerant Market, as companies align their offerings with consumer values.

Expansion of Refrigeration Applications in Emerging Markets

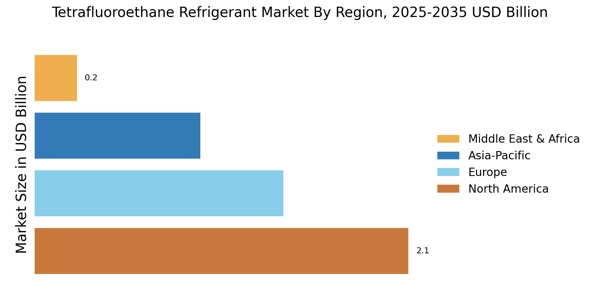

The expansion of refrigeration applications in emerging markets is significantly contributing to the growth of the Tetrafluoroethane Refrigerant Market. As urbanization and economic development progress, there is a rising need for refrigeration in sectors such as food and beverage, pharmaceuticals, and retail. Tetrafluoroethane is being recognized for its efficiency and effectiveness in various refrigeration applications, making it a preferred choice in these markets. Market data suggests that the demand for refrigeration solutions in emerging economies is expected to grow at a robust pace, driven by increased consumer spending and the need for improved cold chain logistics. This trend indicates a promising future for the Tetrafluoroethane Refrigerant Market as it capitalizes on the burgeoning opportunities in these regions.

.png)