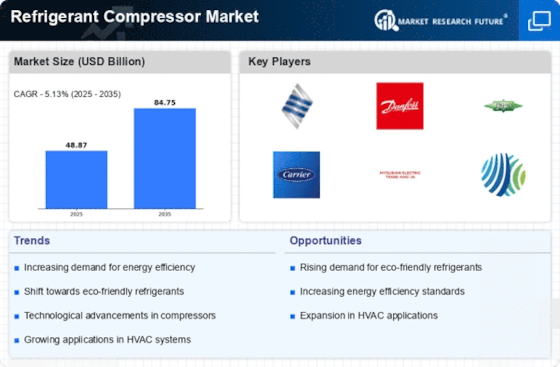

Rising Demand for HVAC Systems

The increasing demand for heating, ventilation, and air conditioning (HVAC) systems is a primary driver for the Refrigerant Compressor Market. As urbanization accelerates, the need for efficient climate control solutions in residential and commercial buildings intensifies. According to recent data, the HVAC sector is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years. This growth is likely to spur the demand for advanced refrigerant compressors, which are essential for optimizing system performance and energy efficiency. Furthermore, the trend towards smart buildings, which require sophisticated HVAC systems, further propels the need for high-quality refrigerant compressors. Consequently, manufacturers are focusing on innovation to meet the evolving requirements of the HVAC market.

Increasing Focus on Energy Efficiency Standards

The growing emphasis on energy efficiency standards is a significant driver for the Refrigerant Compressor Market. As energy costs continue to rise, both consumers and businesses are seeking solutions that minimize energy consumption. Regulatory bodies are establishing stricter energy efficiency standards for HVAC and refrigeration systems, compelling manufacturers to innovate and enhance the efficiency of their refrigerant compressors. For instance, the introduction of the Energy Star certification has encouraged the adoption of high-efficiency compressors. This trend not only benefits end-users through reduced energy bills but also aligns with global sustainability goals. Consequently, the market is likely to witness a surge in demand for energy-efficient refrigerant compressors that comply with these evolving standards.

Technological Advancements in Compressor Design

Technological advancements in compressor design are significantly shaping the Refrigerant Compressor Market. Innovations such as variable speed drives, advanced materials, and enhanced thermal efficiency are becoming increasingly prevalent. These advancements allow for improved performance and energy savings, which are critical in today's energy-conscious environment. For example, the introduction of inverter-driven compressors has revolutionized the market by providing precise control over cooling and heating capacities. This technology not only enhances energy efficiency but also reduces operational costs for end-users. As manufacturers continue to invest in research and development, the market is expected to see a proliferation of next-generation refrigerant compressors that meet the demands of modern applications.

Regulatory Pressure for Environmental Compliance

Regulatory frameworks aimed at reducing greenhouse gas emissions are increasingly influencing the Refrigerant Compressor Market. Governments worldwide are implementing stringent regulations to phase out high global warming potential (GWP) refrigerants. This regulatory pressure is driving manufacturers to develop and adopt more environmentally friendly refrigerant compressors. For instance, the European Union's F-Gas Regulation mandates a significant reduction in the use of hydrofluorocarbons (HFCs), which has led to a surge in demand for compressors compatible with low-GWP refrigerants. As a result, the market is witnessing a shift towards innovative compressor technologies that align with these regulations. This trend not only enhances environmental sustainability but also opens new avenues for growth within the refrigerant compressor sector.

Growth of the Refrigeration and Cold Chain Sector

The expansion of the refrigeration and cold chain sector is a vital driver for the Refrigerant Compressor Market. With the increasing demand for perishable goods and the rise of e-commerce, the need for efficient refrigeration solutions is more pronounced than ever. The cold chain logistics market is projected to grow at a CAGR of around 10% in the coming years, necessitating the use of reliable refrigerant compressors to maintain optimal temperatures during storage and transportation. This growth is particularly evident in the food and pharmaceutical industries, where temperature control is critical. As a result, manufacturers are focusing on developing robust and efficient compressors that can cater to the specific needs of the cold chain sector, thereby driving market growth.