The 5G Infrastructure Market is currently experiencing a transformative phase characterized by rapid advancements in technology and increasing demand for high-speed connectivity. As industries and consumers alike seek enhanced mobile broadband experiences, the deployment of 5G networks is becoming more prevalent. This shift is driven by the need for improved data transmission speeds, reduced latency, and the ability to support a growing number of connected devices. Consequently, various sectors, including telecommunications, automotive, and healthcare, are exploring innovative applications that leverage the capabilities of 5G technology.

Moreover, the competitive landscape within the 5G Infrastructure Market is evolving, with numerous players striving to establish their presence. Collaborations between technology providers and telecommunications companies are becoming more common, as they aim to develop robust infrastructure solutions. Additionally, regulatory frameworks are adapting to facilitate the rollout of 5G networks, which may further accelerate market growth. As the global economy increasingly relies on digital connectivity, the 5G Infrastructure Market appears poised for substantial expansion in the coming years, potentially reshaping how individuals and businesses interact with technology.

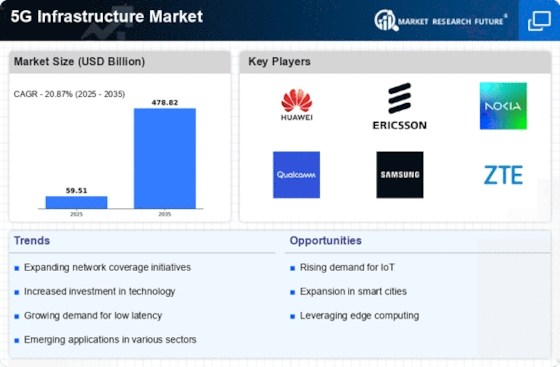

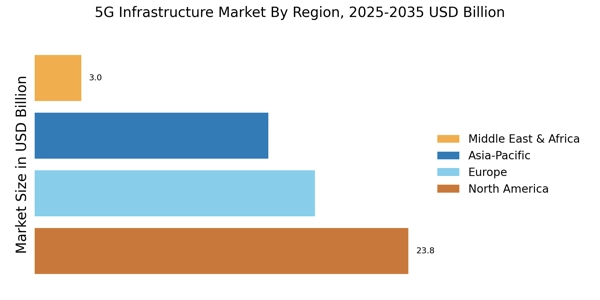

The 5G infrastructure market is undergoing rapid expansion as governments and enterprises invest in next-generation network deployment. The global 5G infrastructure market is witnessing strong momentum driven by large-scale network rollouts across developed and emerging economies. The expansion of 5G network infrastructure is essential for supporting low-latency communication and high data throughput. Growth in the 5G base station market is driven by increasing investments in antennas, small cells, and radio access network equipment. The 5G industry is evolving rapidly, supported by advancements in virtualization, edge computing, and AI-driven network optimization. Expanding 5G industry applications across automotive, healthcare, manufacturing, and smart cities are driving infrastructure demand. Continuous 5G research is enabling improvements in spectrum efficiency, latency reduction, and network reliability. Established infrastructure vendors are increasingly viewed as attractive 5G companies to invest, supported by long-term network expansion plans. Analysts estimate that 5G will be widely available across major economies by the end of the forecast period, driven by accelerated infrastructure deployment. The number of 5G network available countries continues to rise, with North America, Europe, and Asia-Pacific leading global adoption.

Increased Investment in Infrastructure

There is a noticeable trend of heightened investment in 5G infrastructure, as stakeholders recognize the potential benefits of advanced connectivity. This influx of capital is likely to enhance network capabilities and expand coverage, thereby facilitating the adoption of 5G technology across various sectors.

Emergence of Private Networks

The rise of private 5G networks is becoming increasingly evident, particularly among enterprises seeking tailored solutions for their specific needs. These networks may offer enhanced security, reliability, and control, which could be particularly appealing to industries such as manufacturing and logistics.

Integration of IoT and 5G

The convergence of Internet of Things (IoT) devices with 5G infrastructure is gaining traction, as the latter provides the necessary bandwidth and low latency for seamless connectivity. This integration may enable innovative applications in smart cities, healthcare, and transportation, potentially transforming operational efficiencies.