Growing Focus on Sustainability

Sustainability is becoming a central theme in the Telecom Power System Market, as stakeholders increasingly prioritize environmentally friendly practices. Telecom operators are recognizing the importance of reducing their carbon footprint and are actively seeking sustainable power solutions. This focus on sustainability is driving investments in renewable energy sources and energy-efficient technologies. Reports indicate that companies adopting sustainable practices can enhance their brand reputation and customer loyalty, which is crucial in a competitive market. As the demand for sustainable solutions grows, the Telecom Power System Market is likely to evolve, with an emphasis on integrating eco-friendly technologies that align with global sustainability goals.

Rising Adoption of 5G Technology

The rollout of 5G technology is a significant driver for the Telecom Power System Market. As telecom operators upgrade their infrastructure to support 5G networks, the demand for robust power systems is escalating. 5G technology requires more energy due to its higher data transmission rates and increased number of connected devices. This shift necessitates the implementation of advanced power solutions that can handle the increased load while maintaining efficiency. Industry analysts project that the 5G rollout will lead to a substantial increase in power system investments, further propelling the Telecom Power System Market. This trend underscores the critical relationship between telecommunications advancements and power system requirements.

Regulatory Support for Energy Efficiency

Regulatory frameworks promoting energy efficiency are significantly influencing the Telecom Power System Market. Governments are increasingly implementing policies aimed at reducing energy consumption and carbon emissions. These regulations often incentivize telecom operators to adopt energy-efficient power systems, which can lead to substantial cost savings. For instance, energy-efficient systems can reduce operational costs by up to 30%, making them an attractive option for service providers. As a result, the Telecom Power System Market is likely to see a shift towards more sustainable practices, driven by both regulatory compliance and the desire for operational efficiency. This trend not only supports environmental goals but also enhances the competitive edge of telecom operators.

Increasing Demand for Reliable Power Supply

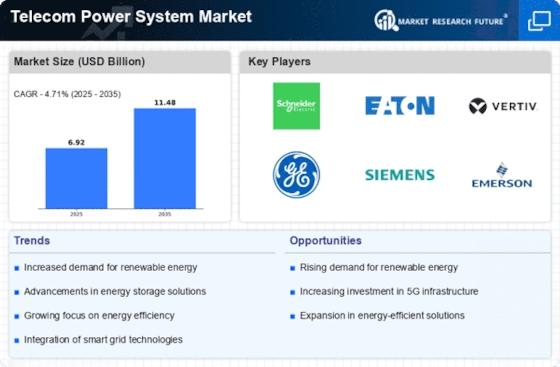

The Telecom Power System Market is experiencing a surge in demand for reliable power supply solutions. As telecommunications networks expand, the need for uninterrupted power becomes paramount. This demand is driven by the proliferation of mobile devices and the increasing reliance on data services. According to industry estimates, the demand for telecom power systems is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of the critical role that power systems play in ensuring network reliability and service continuity. Consequently, telecom operators are investing in advanced power solutions to mitigate outages and enhance service quality, thereby propelling the Telecom Power System Market forward.

Technological Advancements in Power Systems

Technological advancements are reshaping the Telecom Power System Market, introducing innovative solutions that enhance efficiency and reliability. The integration of smart grid technologies and advanced monitoring systems allows for real-time data analysis and improved energy management. These innovations enable telecom operators to optimize their power usage, reduce costs, and minimize downtime. Furthermore, the adoption of renewable energy sources, such as solar and wind, is becoming more prevalent, driven by technological improvements that make these options more viable. As a result, the Telecom Power System Market is witnessing a transformation that not only meets current demands but also anticipates future energy needs.