Rising Urbanization

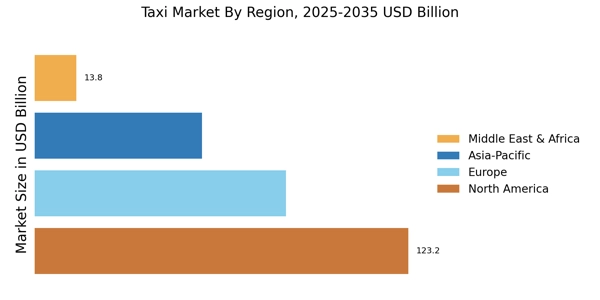

The increasing trend of urbanization appears to be a pivotal driver for the Taxi Market. As more individuals migrate to urban areas, the demand for efficient transportation solutions escalates. In densely populated cities, the reliance on taxis for daily commutes and short-distance travel becomes more pronounced. According to recent data, urban areas are projected to house approximately 68% of the world's population by 2050. This demographic shift suggests a growing need for accessible and reliable taxi services, thereby propelling the Taxi Market forward. Furthermore, urbanization often leads to the development of smart city initiatives, which may integrate taxi services into broader transportation networks, enhancing their appeal and operational efficiency.

Environmental Regulations

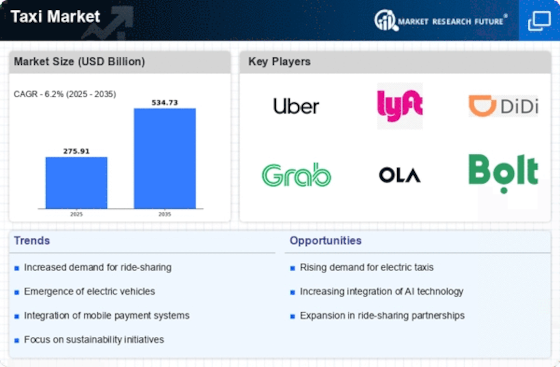

The increasing emphasis on environmental regulations is influencing the Taxi Market significantly. Governments worldwide are implementing stricter emissions standards and promoting the use of electric vehicles (EVs) to combat climate change. This regulatory landscape is compelling taxi operators to transition towards greener alternatives. For instance, cities are offering incentives for taxi companies to adopt electric fleets, which could lead to a substantial reduction in carbon emissions. Data suggests that the electric taxi segment is expected to grow at a compound annual growth rate of over 20% in the coming years. Consequently, the Taxi Market is adapting to these regulations, which may enhance its sustainability profile and appeal to environmentally conscious consumers.

Technological Advancements

Technological advancements are reshaping the Taxi Market in profound ways. The integration of mobile applications for ride-hailing has revolutionized how consumers access taxi services. Data indicates that the ride-hailing segment has seen exponential growth, with revenues expected to reach over 100 billion dollars by 2025. Additionally, innovations such as GPS tracking, cashless payment systems, and real-time analytics are enhancing customer experience and operational efficiency. These technologies not only streamline the booking process but also improve safety and reliability, which are critical factors for consumers. As technology continues to evolve, the Taxi Market is likely to witness further transformations, potentially leading to the emergence of autonomous taxi services in the near future.

Changing Consumer Preferences

Changing consumer preferences are emerging as a significant driver in the Taxi Market. As individuals become more health-conscious and environmentally aware, there is a noticeable shift towards shared mobility solutions. The preference for ride-sharing services over traditional taxi rides is growing, as consumers seek cost-effective and convenient transportation options. Market data indicates that the ride-sharing segment is projected to capture a substantial share of the overall taxi market, potentially exceeding 50% by 2026. This shift suggests that taxi operators may need to adapt their business models to incorporate shared mobility solutions, thereby remaining competitive in an evolving landscape. The Taxi Market must respond to these changing preferences to sustain growth and relevance.

Economic Growth and Disposable Income

Economic growth and rising disposable income levels are likely to drive the Taxi Market forward. As economies recover and expand, individuals tend to have more disposable income, which can lead to increased spending on transportation services. Data shows that in many regions, the middle class is expanding, resulting in a higher demand for convenient and reliable taxi services. This trend is particularly evident in emerging markets, where urban populations are growing, and disposable incomes are rising. Consequently, the Taxi Market may experience a surge in demand as more consumers opt for taxis for both personal and business travel. This economic dynamic could foster innovation and competition within the industry, ultimately benefiting consumers.