North America : Market Leader in Integration

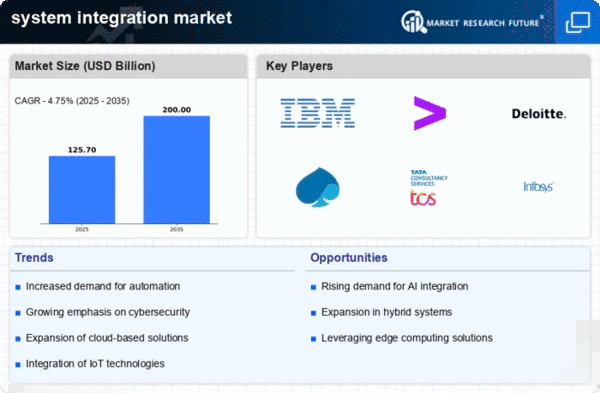

North America continues to lead the system integration market, holding a significant 60.0% share as of 2025. The region's growth is driven by rapid technological advancements, increasing demand for cloud-based solutions, and a strong focus on digital transformation across industries. Regulatory support for innovation and investment in IT infrastructure further catalyze market expansion. Companies are increasingly adopting integrated systems to enhance operational efficiency and customer experience. The competitive landscape in North America is robust, featuring key players such as IBM, Accenture, and Deloitte. These companies leverage their extensive expertise and resources to deliver comprehensive integration solutions. The presence of major technology hubs in the U.S. fosters innovation and collaboration, positioning the region as a global leader in system integration. As organizations seek to streamline processes and improve data management, the demand for integration services is expected to grow significantly.

Europe : Emerging Integration Powerhouse

Europe is witnessing a notable rise in the system integration market, accounting for 30.0% of the global share in 2025. The region's growth is fueled by increasing investments in digital infrastructure, regulatory frameworks promoting technology adoption, and a shift towards automation in various sectors. European companies are focusing on enhancing operational efficiency and customer engagement through integrated solutions, which is driving demand for system integration services. Leading countries such as Germany, France, and the UK are at the forefront of this growth, with a competitive landscape featuring firms like Capgemini and Accenture. The presence of strong regulatory bodies ensures compliance and fosters innovation, creating a conducive environment for market players. As organizations increasingly recognize the value of integrated systems, the demand for these services is expected to rise, further solidifying Europe's position in the global market.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is emerging as a significant player in the system integration market, holding a 25.0% share in 2025. This growth is driven by rapid urbanization, increasing adoption of cloud technologies, and a rising focus on digital transformation across various industries. Governments in the region are implementing policies to support technological advancements, which further stimulates demand for system integration services as businesses seek to enhance efficiency and competitiveness. Countries like India and China are leading the charge, with a competitive landscape that includes major players such as Tata Consultancy Services and Infosys. The region's diverse market presents both opportunities and challenges, as companies navigate varying regulatory environments and customer needs. As the demand for integrated solutions continues to grow, the Asia-Pacific market is poised for substantial expansion in the coming years.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region, while currently holding a smaller share of 5.0% in the system integration market, is poised for growth. The region's development is driven by increasing investments in technology infrastructure, a growing emphasis on digital transformation, and supportive government initiatives aimed at enhancing IT capabilities. As businesses in MEA recognize the importance of integrated systems, demand for system integration services is expected to rise significantly in the coming years. Countries such as the UAE and South Africa are leading the way, with a competitive landscape that includes both local and international players. The presence of key firms is gradually increasing, as companies seek to capitalize on the region's untapped potential. As the market matures, the focus on integrated solutions will likely intensify, paving the way for future growth in the MEA region.