Synthetic Paper Size

Synthetic Paper Market Growth Projections and Opportunities

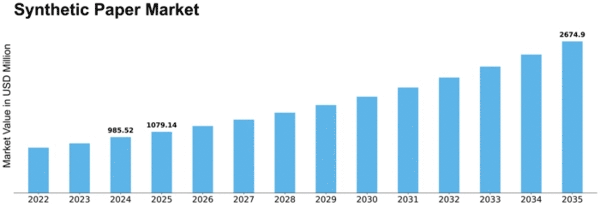

Many market aspects shape synthetic paper market elements and development. Growing demand for eco-friendly paper is propelling the business. Synthetic paper, which is recyclable and sturdy, matches modern and client preferences for sustainable arrangements. Every 2022, synthetic paper market size was USD 0.8 billion. A 9.50% CAGR is expected for the synthetic paper sector from USD 0.9 Billion in 2023 to USD 1.8 Billion in 2032.

Mechanical developments also affect synthetic paper. Advanced manufacturing methods and materials have produced high-performance synthetic papers for various uses. High-level coatings and additional compounds make synthetic paper water, compound, and tear-safe for naming, packaging, and printing.

Global economic conditions affect synthetic paper sales. Synthetic paper interest rises as economies grow and firms demand bundling, unique materials, and names. Partnerships cut inconsequential spending during financial slumps, slowing market improvement.

Government policies and laws also affect markets. Synthetic paper has become due to strict environmental standards that reduce carbon footprint and increase sustainability. Due to territorial boycotts, synthetic paper can replace single-use plastics in many applications.

Purchaser behavior greatly impacts synthetic paper market factors. Buyers are more environmentally conscious and want affordable products and bundles. This client mindset shift has spurred synthetic paper sales, growing the market.

The synthetic paper industry is also competitive. Key companies, market tactics, and product leaps fuel market competition. Makers, providers, and end-clients collaborate to create a stable synthetic paper environment.

Market factors like unrefined commodity costs and accessibility affect synthetic paper. Unrefined materials like BOPP and HDPE can be affected by production network disruptions and international events. These variants affect synthetic paper costs and estimates.

Finally, mechanical disturbances and selected material breakthroughs confront synthetic paper with obstacles and fantastic opportunities. Computerized printing and smart bundling are altering printing and bundling. Synthetic paper benefits from new printing techniques but also faces competition from new materials.

Leave a Comment