Growing Demand for Grid Stability

The demand for grid stability is a critical driver in the Synchronous Condenser Market. As energy systems become more complex, the need for reliable voltage control and reactive power support has intensified. Synchronous condensers are uniquely positioned to address these challenges, providing essential services that enhance grid reliability. The increasing frequency of extreme weather events and the subsequent impact on energy infrastructure have further underscored the necessity for robust grid solutions. Market analysis indicates that the demand for synchronous condensers is likely to rise significantly, with estimates suggesting a potential increase in installations by over 20% in the next few years. This trend reflects a broader recognition of the importance of maintaining grid integrity in an evolving energy landscape.

Regulatory Support and Incentives

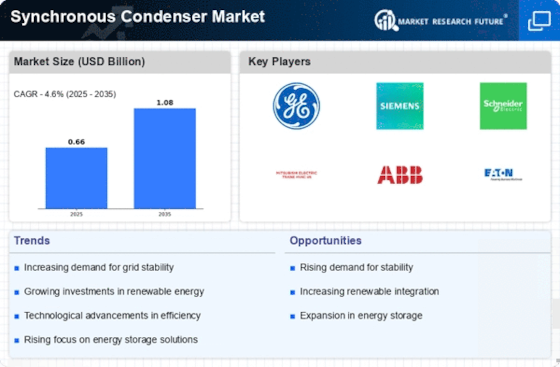

Regulatory frameworks play a pivotal role in shaping the Synchronous Condenser Market. Governments are increasingly recognizing the importance of grid stability and reliability, leading to the implementation of supportive policies and incentives. These regulations often encourage the adoption of synchronous condensers as a means to enhance grid performance and facilitate the integration of renewable energy sources. For instance, various regions have introduced financial incentives for utilities to invest in synchronous condenser technology, which can improve voltage stability and reduce transmission losses. This regulatory support is expected to drive market growth, with projections indicating that the market could reach a valuation of several billion dollars by the end of the decade, reflecting the increasing prioritization of energy security.

Integration of Renewable Energy Sources

The integration of renewable energy sources is a significant factor influencing the Synchronous Condenser Market. As countries strive to meet ambitious renewable energy targets, the need for technologies that can support grid stability becomes paramount. Synchronous condensers offer a viable solution by providing essential reactive power and voltage regulation, which are critical for accommodating the variability of renewable energy generation. The market is witnessing a surge in demand for these systems, particularly in regions with high levels of wind and solar energy deployment. Projections indicate that the market for synchronous condensers could expand by approximately 15% annually as utilities and energy providers seek to enhance their grid infrastructure to support renewable integration.

Increased Investment in Power Infrastructure

Increased investment in power infrastructure is a driving force behind the Synchronous Condenser Market. As aging power systems require modernization, utilities are allocating significant resources to upgrade their infrastructure. This investment often includes the deployment of synchronous condensers, which are essential for improving grid reliability and performance. The trend towards smart grid technologies further amplifies this need, as utilities seek to enhance their operational capabilities. Market forecasts suggest that the investment in power infrastructure could exceed hundreds of billions of dollars over the next decade, with a substantial portion directed towards synchronous condenser installations. This trend indicates a robust growth trajectory for the market, as stakeholders recognize the value of investing in reliable and efficient energy solutions.

Technological Advancements in Energy Storage

The Synchronous Condenser Market is experiencing a notable shift due to advancements in energy storage technologies. Innovations in battery systems and energy management software are enhancing the operational efficiency of synchronous condensers. These developments allow for better integration of renewable energy sources, which is crucial as the energy landscape evolves. The ability to provide reactive power support and voltage regulation is becoming increasingly important, particularly in regions with high penetration of intermittent renewable energy. As a result, the market for synchronous condensers is projected to grow, with estimates suggesting a compound annual growth rate of around 6% over the next five years. This growth is indicative of the industry's response to the need for more reliable and resilient power systems.