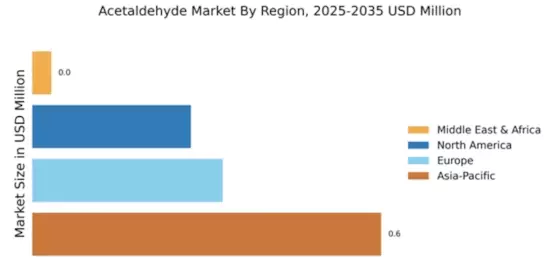

North America : Established Market with Growth Potential

The North American acetaldehyde market is poised for growth, driven by increasing demand in various applications such as plastics, resins, and solvents. With a market share of 25%, the region benefits from a robust industrial base and regulatory support for chemical manufacturing. The push for sustainable practices is also influencing market dynamics, as companies seek eco-friendly alternatives. Leading countries like the US and Canada are home to major players such as Eastman Chemical Company and Celanese Corporation. The competitive landscape is characterized by innovation and strategic partnerships, enhancing production capabilities. The presence of established firms ensures a steady supply chain, while ongoing investments in R&D are expected to further boost market growth.

Europe : Innovation and Sustainability Focus

Europe's acetaldehyde market, holding a 30% share, is driven by stringent regulations promoting sustainability and innovation in chemical production. The region's commitment to reducing carbon emissions and enhancing product safety is fostering demand for acetaldehyde in various applications, including pharmaceuticals and agrochemicals. Regulatory frameworks are encouraging the adoption of greener technologies, which is expected to shape market dynamics positively. Germany, France, and the UK are leading countries in this market, with key players like BASF SE and Oxea GmbH driving innovation. The competitive landscape is marked by a focus on sustainable practices and technological advancements. Collaborations between industry and research institutions are enhancing product development, ensuring that Europe remains at the forefront of the acetaldehyde market.

Asia-Pacific : Emerging Powerhouse in Acetaldehyde

Asia-Pacific is the leading region in the acetaldehyde market, commanding a 55% share due to rapid industrialization and increasing demand from end-use industries such as textiles and automotive. The region's growth is fueled by expanding economies, particularly in China and India, where urbanization and rising disposable incomes are driving consumption. Regulatory support for chemical manufacturing is also a significant catalyst for growth. China is the dominant player in this market, with major companies like Mitsubishi Gas Chemical Company and Formosa Plastics Corporation leading production. The competitive landscape is characterized by a mix of local and international players, ensuring a diverse supply chain. Investments in capacity expansion and technological advancements are expected to further enhance the region's market position.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa (MEA) acetaldehyde market, with a modest share of 3%, is gradually emerging as a potential growth area. The region's industrial sector is expanding, driven by investments in petrochemicals and a growing demand for acetaldehyde in various applications. Regulatory frameworks are evolving, supporting the development of the chemical industry and encouraging sustainable practices. Countries like Saudi Arabia and South Africa are key players in this market, with local companies beginning to establish a foothold. The competitive landscape is still developing, but the presence of international firms is fostering knowledge transfer and innovation. As infrastructure improves and regulatory support strengthens, the MEA region is expected to see increased activity in the acetaldehyde market.