Market Growth Projections

The Global Surgical Drills Market Industry is poised for significant growth, with projections indicating a market value of 1.01 USD Billion in 2024 and an anticipated increase to 1.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.89% from 2025 to 2035. Such figures reflect the increasing reliance on surgical drills in various medical procedures, driven by advancements in technology and rising surgical demands. The market's expansion is indicative of broader trends in healthcare, where surgical precision and efficiency are paramount, highlighting the importance of surgical drills in modern medical practice.

Rising Surgical Procedures

An increase in the number of surgical procedures globally significantly impacts the Global Surgical Drills Market Industry. Factors such as an aging population and the prevalence of chronic diseases contribute to this rise. For example, the World Health Organization indicates that surgical interventions are essential for treating various conditions, leading to a higher demand for surgical drills. This trend is expected to continue, with projections estimating the market will reach 1.9 USD Billion by 2035. The growing need for efficient and reliable surgical tools underscores the importance of surgical drills in modern healthcare, indicating a sustained growth trajectory.

Technological Advancements

The Global Surgical Drills Market Industry experiences substantial growth driven by rapid technological advancements. Innovations in drill design, such as the integration of robotics and improved ergonomics, enhance precision and reduce surgical complications. For instance, the introduction of smart surgical drills equipped with sensors allows for real-time feedback during procedures, potentially improving outcomes. As of 2024, the market is valued at 1.01 USD Billion, reflecting the increasing adoption of these advanced tools in surgical settings. The ongoing development of minimally invasive techniques further propels demand, suggesting a robust trajectory for the industry as it adapts to evolving surgical practices.

Regulatory Support and Standards

Regulatory support and the establishment of stringent standards play a crucial role in shaping the Global Surgical Drills Market Industry. Governments and health organizations are actively promoting the use of certified surgical drills to ensure patient safety and efficacy. Compliance with these regulations often necessitates continuous improvement and innovation among manufacturers, fostering a competitive environment that benefits the market. As the industry adapts to these standards, it is likely to see enhanced product quality and reliability, which could further stimulate demand. The ongoing evolution of regulatory frameworks indicates a proactive approach to improving surgical practices globally.

Growing Demand for Minimally Invasive Surgery

The shift towards minimally invasive surgical techniques significantly influences the Global Surgical Drills Market Industry. These techniques offer numerous benefits, including reduced recovery times and lower risk of complications, which are increasingly appealing to both patients and healthcare providers. As a result, there is a growing demand for specialized surgical drills designed for these procedures. The market's evolution is evident as manufacturers develop tools that cater specifically to the needs of minimally invasive surgeries. This trend not only enhances patient outcomes but also drives market growth, suggesting a promising future for surgical drill innovations.

Increased Investment in Healthcare Infrastructure

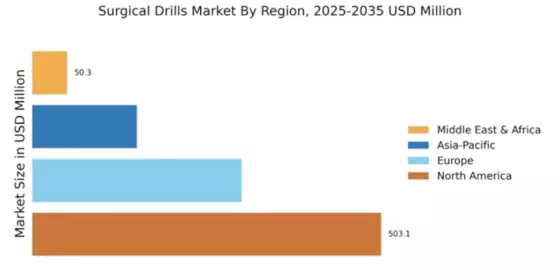

The Global Surgical Drills Market Industry benefits from increased investment in healthcare infrastructure across various regions. Governments and private entities are allocating substantial resources to enhance surgical facilities, particularly in emerging economies. This investment often includes the procurement of advanced surgical equipment, including drills, to improve surgical outcomes and patient care. As healthcare systems evolve, the demand for high-quality surgical tools is likely to rise, supporting the market's growth. The anticipated compound annual growth rate of 5.89% from 2025 to 2035 reflects the positive outlook for the industry as healthcare infrastructure continues to expand.