Rising Awareness of Power Quality

In the Surge Arrester Market, there is a growing awareness regarding the importance of power quality among consumers and industries alike. Fluctuations in voltage can lead to significant operational disruptions and equipment damage, prompting organizations to invest in protective measures. The increasing reliance on sensitive electronic equipment across various sectors, including manufacturing and telecommunications, has heightened the focus on maintaining stable power supply. Market data indicates that the power quality equipment market is expected to grow at a compound annual growth rate of 6.5% through 2027. This trend suggests that as industries prioritize power quality, the demand for surge arresters will likely increase, positioning them as essential components in safeguarding electrical systems.

Growth in Renewable Energy Sources

The Surge Arrester Market is poised for growth due to the increasing adoption of renewable energy sources. As countries strive to meet sustainability targets, investments in solar, wind, and other renewable energy technologies are on the rise. These energy sources often require specialized surge protection to safeguard against voltage fluctuations that can occur during energy generation and distribution. The renewable energy market is projected to grow at a compound annual growth rate of 8% through 2030, which suggests a corresponding increase in the demand for surge arresters. This trend indicates that as the energy landscape evolves, the Surge Arrester Market will likely benefit from the need for enhanced protection mechanisms in renewable energy systems.

Regulatory Frameworks and Standards

The Surge Arrester Market is significantly influenced by the establishment of regulatory frameworks and standards aimed at ensuring electrical safety and reliability. Governments and regulatory bodies are increasingly mandating the use of surge protection devices in various applications, including residential, commercial, and industrial sectors. Compliance with these regulations not only enhances safety but also promotes the adoption of surge arresters as essential components in electrical systems. Recent data indicates that the global market for electrical safety equipment is expected to reach USD 15 billion by 2025, driven in part by stringent regulatory requirements. This regulatory landscape is likely to bolster the Surge Arrester Market, as manufacturers and consumers alike prioritize compliance and safety in their electrical installations.

Integration of Smart Grid Technologies

The integration of smart grid technologies is emerging as a pivotal driver in the Surge Arrester Market. Smart grids enhance the efficiency and reliability of electricity distribution, necessitating advanced protective devices such as surge arresters. These technologies facilitate real-time monitoring and management of electrical systems, which can mitigate the risks associated with voltage surges. As smart grid initiatives gain traction, the demand for surge arresters is expected to rise correspondingly. Recent estimates suggest that investments in smart grid technologies could exceed USD 100 billion by 2025, indicating a robust market potential for surge arresters. This integration not only improves operational efficiency but also aligns with sustainability goals, further propelling the Surge Arrester Market.

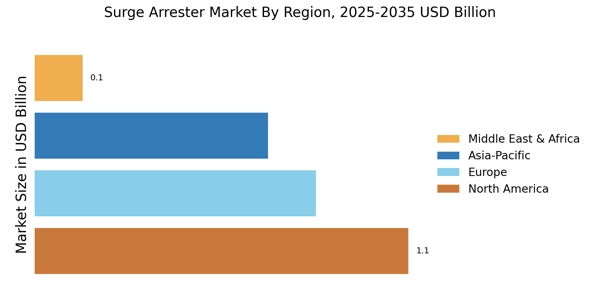

Increasing Demand for Electrical Infrastructure

The Surge Arrester Market is experiencing a notable surge in demand due to the ongoing expansion of electrical infrastructure. As urbanization accelerates, the need for reliable power distribution systems becomes paramount. This trend is particularly evident in developing regions, where investments in electrical grids are on the rise. According to recent data, The Surge Arrester Market is projected to reach USD 3 trillion by 2026, which directly correlates with the increasing adoption of surge arresters. These devices play a critical role in protecting electrical systems from voltage spikes, thereby ensuring the longevity and reliability of power distribution networks. Consequently, the growth of electrical infrastructure is likely to drive the Surge Arrester Market forward, as stakeholders seek to enhance system resilience and minimize downtime.