Surge Arrester Size

Market Size Snapshot

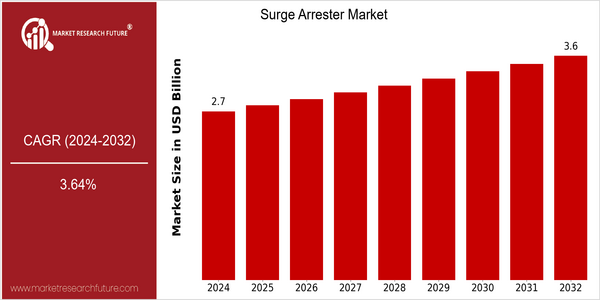

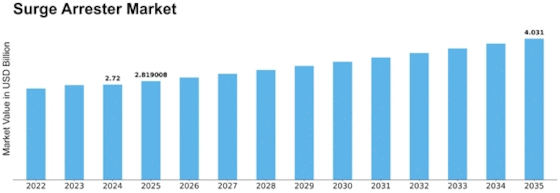

| Year | Value |

|---|---|

| 2024 | USD 2.72 Billion |

| 2032 | USD 3.62 Billion |

| CAGR (2024-2032) | 3.64 % |

Note – Market size depicts the revenue generated over the financial year

The surge arrester market is growing steadily. Its current value is $ 2.72 billion and is expected to reach $ 3.62 billion by 2032. The compound annual growth rate (CAGR) for this period is 3.64%. This growth is driven by the increasing need for reliable power systems and the need to protect against overvoltage in various industries. The surge arrester is becoming more and more important as the industry becomes more and more dependent on the use of sensitive electrical equipment. Also, technological advances, such as the development of more efficient and durable surge arresters, contribute to market growth. Materials and designs are improving, making surge arresters more effective and durable. Also, strategic initiatives by leading companies such as Siemens AG, Schneider Electric, and ABB, such as the establishment of strategic alliances and product launches, help to strengthen their position in the market. Moreover, the integration of smart grid and automation technology into surge protection solutions is expected to further drive market growth.

Regional Market Size

Regional Deep Dive

The surge arrester market is growing in all regions of the world, driven by increasing demand for electrical safety and reliability in the electrical power system. North America's market is characterized by its robust power grid and stringent regulatory standards, while Europe focuses on the integration of sustainable energy sources and the integration of renewable energy sources. Asia-Pacific is experiencing rapid urbanization and industrialization, resulting in increased investment in electrical equipment. The Middle East and Africa are focusing on grid stability, and Latin America is gradually adopting advanced technology to enhance electrical safety. Each region has its own opportunities and challenges, which will affect the market's development in the future.

Europe

- The European market is seeing a shift towards eco-friendly surge arresters, with the European Union's Green Deal promoting sustainable energy practices and encouraging manufacturers to innovate in this space.

- Regulatory changes, such as the IEC 61643-11 standard, are pushing for higher performance standards in surge protection devices, compelling companies like Schneider Electric to invest in R&D for compliant products.

Asia Pacific

- Rapid urbanization in countries like India and China is leading to increased investments in electrical infrastructure, with local companies such as ABB and Mitsubishi Electric expanding their surge arrester offerings to meet growing demand.

- Government initiatives aimed at enhancing power reliability, such as India's 'Power for All' program, are driving the adoption of surge protection technologies in the region.

Latin America

- Latin America is gradually adopting advanced surge protection technologies, with Brazil's National Electric Energy Agency (ANEEL) implementing regulations that encourage the use of surge arresters in new electrical installations.

- The region is witnessing collaborations between local and international companies, such as Schneider Electric and local utilities, to enhance electrical safety and reliability in power distribution networks.

North America

- The North American market is heavily influenced by the National Electrical Manufacturers Association (NEMA), which has established standards for surge protection devices, ensuring high safety and performance levels.

- Recent advancements in smart grid technology are driving the adoption of surge arresters, with companies like Siemens and Eaton leading the way in developing innovative solutions that enhance grid resilience.

Middle East And Africa

- The Middle East is focusing on diversifying its energy sources, with countries like the UAE investing in renewable energy projects that require advanced surge protection solutions to safeguard infrastructure.

- In Africa, initiatives like the African Development Bank's 'New Deal on Energy for Africa' are promoting investments in electrical safety, leading to increased demand for surge arresters in emerging markets.

Did You Know?

“Surge arresters can protect electrical equipment from voltage spikes caused by lightning strikes, which can reach up to 1 million volts.” — IEEE Power and Energy Society

Segmental Market Size

Currently the surge arrester market is experiencing steady growth, driven by the growing need for electrical safety and reliability in many industries. Regulatory requirements to ensure electrical safety are also a driving force in this market. In addition, the development of surge protection technology is driving innovation and adoption across all industries. At the present time, the surge arrester market is at a mature stage of development, with the leading players, such as Siemens and Schneider, deploying their advanced surge protection solutions in commercial and industrial applications. These solutions are used in a variety of applications, such as in the protection of sensitive equipment in data centers, in the protection of renewable energy sources and in the protection of telecommunications equipment. These solutions are increasingly used in the transportation and building industries. The trend towards energy efficiency and the growing reliance on digital infrastructure are driving the growth of the surge arrester market. Emerging technology, such as IoT-enabled surge protection devices, will continue to drive the development of this market.

Future Outlook

The Surge Arrester Market is expected to show a steady growth from 2024 to 2032, with an estimated CAGR of 3.64% from $2.72 billion to $3.62 billion. This growth will be supported by the growing demand for reliable power systems and the increasing frequency of surges due to the occurrence of extreme weather conditions and technological developments. The surge protection market will grow with the increasing dependence of both consumers and industries on electrical equipment. Also, the integration of smart grids and the development of more efficient surge protection devices will benefit the market. The expansion of the surge protection market will be further accelerated by the implementation of government policies aimed at improving the electrical grid and energy efficiency. The growing use of renewable energy sources and the electrification of the transport sector will also increase the demand for surge arresters, as these systems require a high degree of protection against surges. Moreover, the growing awareness of the need for electrical safety and the technological developments will boost the surge arrester market.

Leave a Comment