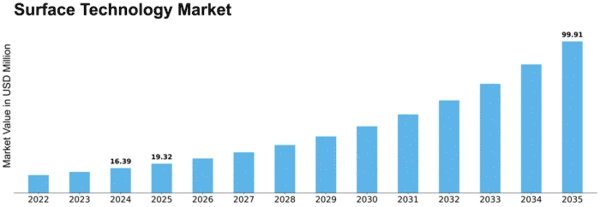

Surface Technology Size

Surface Technology Market Growth Projections and Opportunities

The surface technology market is influenced by various factors that shape its dynamics and growth trajectory. One significant market factor is technological advancements. Innovations in surface coating materials, application methods, and machinery continually drive the market forward. With advancements such as nanotechnology and smart coatings, surface technology solutions become more versatile, durable, and efficient, catering to diverse industry needs.

Moreover, economic conditions play a crucial role in the surface technology market. Economic stability, growth rates, and disposable income levels directly impact industries' spending on surface treatments. During periods of economic expansion, industries invest more in upgrading surface technologies to enhance product quality and competitiveness. Conversely, economic downturns may lead to reduced investments in surface technology solutions as companies prioritize cost-cutting measures.

Globalization also significantly influences the surface technology market. The interconnectedness of economies and the expansion of international trade create both opportunities and challenges for surface technology providers. Growing demand from emerging markets, particularly in Asia-Pacific regions, drives market growth. However, intensifying competition from international players and fluctuating currency exchange rates pose challenges for domestic surface technology companies.

The growth of the aerospace industry on the backdrop of increased tourism and business travels; both international and domestic, fuel the demand for surface technology to protect for corrosion, finishing and anodizing, as well as new aircraft manufacturing.

Environmental regulations and sustainability concerns are increasingly shaping the surface technology market landscape. Stringent regulations regarding emissions, waste disposal, and hazardous substances drive the adoption of eco-friendly surface treatment solutions. As sustainability becomes a priority for industries across sectors, there is a rising demand for environmentally friendly coatings, such as water-based or powder coatings, which minimize environmental impact without compromising performance.

Industry trends and consumer preferences also influence the surface technology market. For instance, the automotive industry's shift towards electric vehicles (EVs) and lightweight materials necessitates surface treatments that offer corrosion resistance and thermal stability while reducing weight and enhancing energy efficiency. Similarly, trends in consumer electronics drive demand for surface coatings that provide scratch resistance, fingerprint repellency, and aesthetics.

Furthermore, raw material prices and availability play a critical role in shaping the surface technology market. Fluctuations in raw material prices, particularly for key components like polymers, metals, and specialty chemicals, directly impact production costs and pricing strategies of surface treatment providers. Additionally, disruptions in the supply chain, such as natural disasters or geopolitical tensions, can lead to shortages or price hikes, affecting market dynamics.

Market competition and industry consolidation are key factors influencing the surface technology market. Intense competition among players drives innovation, product differentiation, and pricing strategies. Market consolidation through mergers, acquisitions, and strategic partnerships allows companies to expand their market presence, enhance technological capabilities, and streamline operations to better serve customers' needs.

Moreover, technological adoption rates and infrastructure development influence the surface technology market's growth trajectory. Regions with robust infrastructure and advanced manufacturing facilities tend to adopt surface technology solutions more readily, driving market demand. Additionally, investments in research and development, education, and workforce training are crucial for fostering technological innovation and market growth.

Leave a Comment