Rising Demand in Electrical Utilities

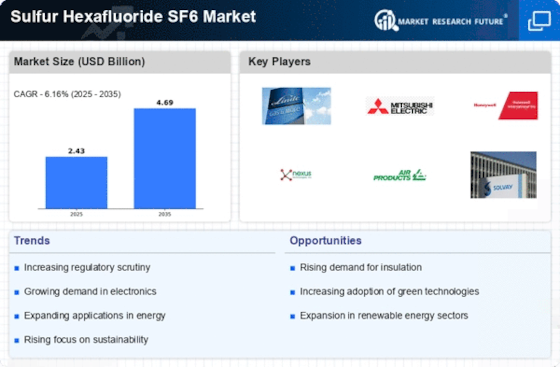

The Sulfur Hexafluoride Sf6 Sale Market is experiencing a surge in demand from electrical utilities, which are increasingly relying on SF6 for its excellent insulating properties. As of 2025, the global demand for electricity continues to rise, necessitating the expansion and modernization of electrical infrastructure. SF6 is integral to this modernization, particularly in high-voltage applications where reliability and efficiency are paramount. The increasing investments in grid infrastructure and renewable energy projects are likely to bolster the sales of SF6, as utilities seek to enhance their operational capabilities. This trend underscores the critical role of SF6 in the evolving energy landscape.

Increased Focus on Sustainable Practices

The Sulfur Hexafluoride Sf6 Sale Market is increasingly aligning with sustainability initiatives as companies seek to reduce their carbon footprints. The growing awareness of environmental issues is prompting industries to explore alternatives to SF6, which is known for its high global warming potential. As of 2025, there is a noticeable shift towards sustainable practices, with many organizations committing to carbon neutrality. This trend may lead to a reevaluation of SF6 usage in certain applications, potentially impacting sales. However, the industry is also likely to see innovations that enhance the sustainability of SF6 applications, suggesting a complex interplay between environmental goals and market dynamics.

Growing Applications in Medical Technology

The Sulfur Hexafluoride Sf6 Sale Market is witnessing an expansion in applications beyond traditional electrical uses, particularly in the medical sector. SF6 is utilized in various medical imaging techniques, such as ultrasound, where it serves as a contrast agent. As of 2025, the demand for advanced medical technologies is on the rise, leading to increased utilization of SF6 in healthcare applications. This diversification of applications is likely to create new revenue streams for the Sulfur Hexafluoride Sf6 Sale Market, as healthcare providers seek to enhance diagnostic capabilities and patient outcomes. The intersection of technology and healthcare is thus a promising avenue for market growth.

Technological Advancements in Gas Insulation

Technological innovations are playing a pivotal role in shaping the Sulfur Hexafluoride Sf6 Sale Market. Advances in gas-insulated switchgear (GIS) technology are enhancing the efficiency and reliability of electrical systems. The integration of SF6 in these systems is crucial for their performance, as it provides superior insulation properties. As of 2025, the market is expected to grow due to the increasing adoption of GIS in various sectors, including utilities and renewable energy. This growth indicates a robust demand for SF6, as companies seek to leverage its benefits in high-voltage applications, thereby driving sales in the Sulfur Hexafluoride Sf6 Sale Market.

Regulatory Compliance and Environmental Standards

The Sulfur Hexafluoride Sf6 Sale Market is increasingly influenced by stringent regulatory frameworks aimed at reducing greenhouse gas emissions. Governments and regulatory bodies are implementing policies that necessitate the use of alternatives to high-GWP gases like SF6. This regulatory pressure is driving manufacturers to innovate and seek compliant solutions, thereby impacting the sales dynamics within the industry. As of 2025, the market is witnessing a shift towards more sustainable practices, with a projected increase in demand for SF6 alternatives. This trend suggests that companies operating in the Sulfur Hexafluoride Sf6 Sale Market must adapt to these regulations to maintain competitiveness and market share.