Increasing Health Consciousness

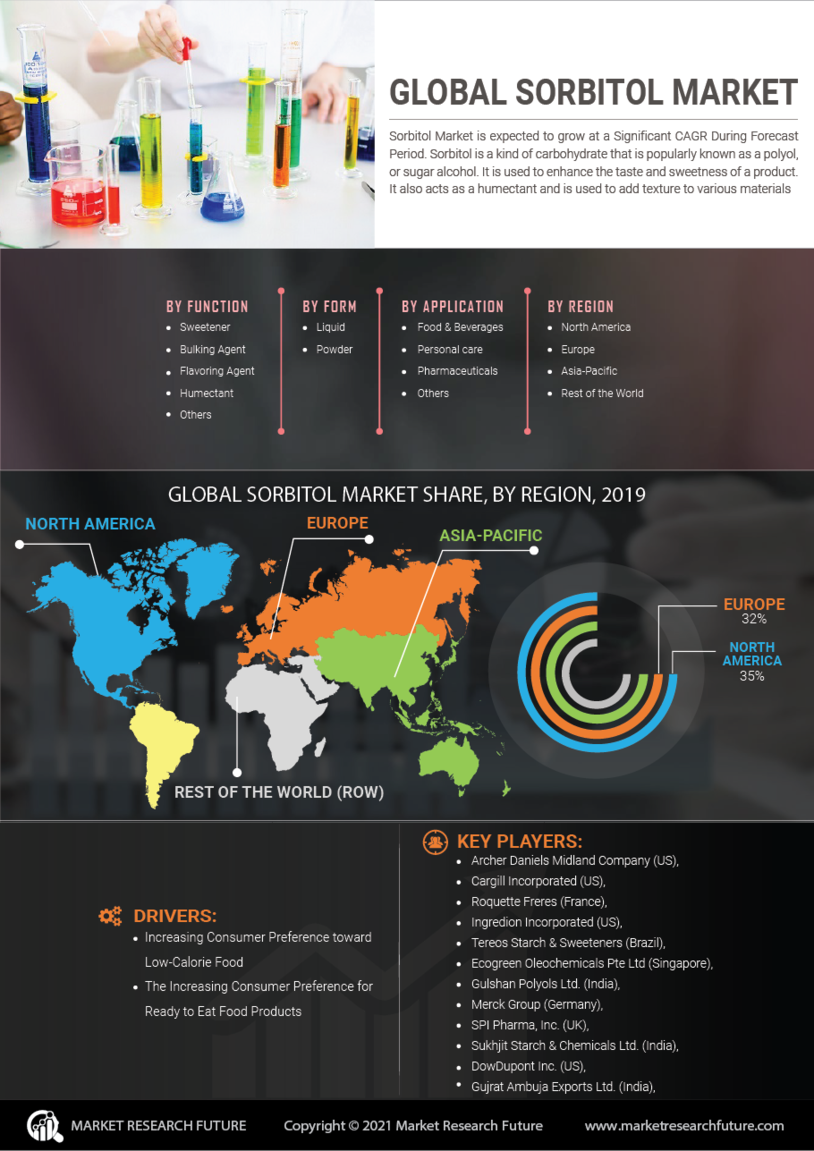

The rising awareness regarding health and wellness among consumers appears to be a pivotal driver for the Sorbitol Market. As individuals become more health-conscious, there is a marked shift towards low-calorie and sugar-free products. Sorbitol Market, being a sugar alcohol with lower caloric content, is increasingly favored in food and beverage formulations. According to recent data, the demand for sugar substitutes, including sorbitol, is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This trend is likely to bolster the Sorbitol Market as manufacturers seek to cater to the evolving preferences of health-oriented consumers.

Growth in the Food and Beverage Sector

The food and beverage sector continues to expand, which significantly influences the Sorbitol Market. Sorbitol Market is widely utilized as a sweetener, humectant, and texturizer in various food products, including confectionery, baked goods, and dairy items. The increasing consumption of processed foods, driven by urbanization and changing lifestyles, is likely to enhance the demand for sorbitol. Market data indicates that the food and beverage industry accounts for a substantial share of the sorbitol consumption, with projections suggesting that this segment will maintain a steady growth trajectory, further solidifying the position of sorbitol as a key ingredient in food formulations.

Technological Advancements in Production

Technological innovations in the production of sorbitol are emerging as a significant driver for the Sorbitol Market. Advances in manufacturing processes, such as enzymatic conversion and fermentation techniques, are enhancing the efficiency and sustainability of sorbitol production. These innovations not only reduce production costs but also improve the quality of the final product. As manufacturers adopt these advanced technologies, the supply of sorbitol is expected to increase, potentially leading to lower prices and greater accessibility. This shift may encourage more industries to incorporate sorbitol into their products, thereby expanding the market reach and applications of sorbitol.

Regulatory Support for Sugar Alternatives

Regulatory frameworks that promote the use of sugar alternatives are likely to bolster the Sorbitol Market. Governments and health organizations are increasingly advocating for reduced sugar consumption due to its association with various health issues. This regulatory support is encouraging food and beverage manufacturers to explore sugar substitutes, including sorbitol, as viable alternatives. Recent initiatives aimed at reducing sugar intake have led to a favorable environment for the growth of sugar alcohols. As a result, the Sorbitol Market is poised to benefit from these regulatory trends, which may further stimulate innovation and product development in the sector.

Rising Demand in Pharmaceutical Applications

The pharmaceutical industry is witnessing a surge in the utilization of sorbitol, which serves as an excipient in various formulations. This trend is indicative of the broader growth within the Sorbitol Market. Sorbitol Market's properties, such as its ability to enhance the stability and solubility of active ingredients, make it a valuable component in drug formulations. Recent statistics suggest that the pharmaceutical segment is expected to experience a growth rate of around 4% annually, driven by the increasing need for effective drug delivery systems. Consequently, the rising demand for sorbitol in pharmaceuticals is likely to contribute positively to the overall dynamics of the Sorbitol Market.