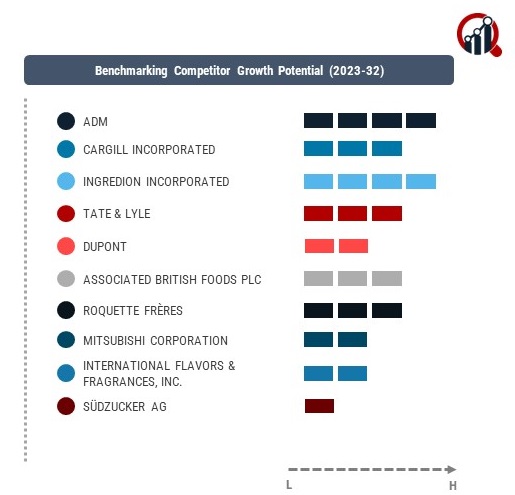

Top Industry Leaders in the Sugar Alcohol Market

The sugar alcohols market has witnessed a significant surge in recent years owing to increased consumer demand for healthier alternatives to sugar. This market's competitive landscape is vibrant, driven by several

Strategies adopted

Strategies adopted by these key players revolve around product innovation, strategic partnerships, and geographical expansion. Companies like Cargill and ADM have focused on expanding their product lines to cater to a broader consumer base. For instance, Cargill introduced erythritol, a sugar alcohol with zero calories, appealing to health-conscious consumers. Meanwhile, Ingredion has pursued strategic collaborations and acquisitions, enhancing its technological capabilities and market reach. These strategies not only strengthen their positions but also foster growth and sustainability in a fiercely competitive market.

Factors influencing market share analysis in the sugar alcohols industry encompass product quality, pricing strategies, distribution channels, and consumer preferences. Quality remains a paramount factor for consumers, driving them to opt for sugar alcohols that mimic the taste and texture of sugar while offering health benefits. Additionally, competitive pricing strategies play a pivotal role, influencing consumer purchasing decisions. Moreover, effective distribution channels, both online and offline, are crucial in reaching a wider audience and gaining market share.

Emerging Companies

Amidst the established players, new and emerging companies are making their mark in the sugar alcohols market by introducing innovative products and technologies. Start-ups like Xylitol Canada and Sweet Green Fields are leveraging advancements in biotechnology to develop novel sugar alcohol-based products that cater to specific consumer demands, such as organic or non-GMO options. These emerging companies disrupt the market by introducing niche products, thereby intensifying competition and challenging the market dominance of established players.

Industry news within the sugar alcohols market often revolves around advancements in production techniques, regulatory developments, and shifts in consumer preferences. The industry has witnessed increased regulatory scrutiny regarding labeling and health claims associated with sugar alcohols. Additionally, the rising trend of clean-label products and growing awareness of the health implications of excessive sugar consumption continue to shape the market dynamics.

Regarding current company investment trends, there's a significant focus on research and development aimed at enhancing the taste, texture, and functionality of sugar alcohol-based products. Companies are investing in cutting-edge technologies to improve manufacturing processes, ensuring higher purity and better quality products. Furthermore, investments in marketing and advertising campaigns play a crucial role in brand visibility and consumer education, influencing purchasing decisions.

Competitive Scenario

Overall, the competitive scenario in the sugar alcohols market remains dynamic and intense, characterized by innovation, strategic maneuvers, and a constant drive for product improvement. Key players strive to maintain their market positions through diversification, partnerships, and technological advancements. Emerging companies disrupt the status quo by introducing unique offerings, fostering a competitive environment that ultimately benefits consumers with a wider array of choices and healthier alternatives to traditional sugar.

Recent Development

In 2022, Südzucker and Cargill established a joint venture to produce maltitol, another sugar alcohol, at a new plant in China. This venture leverages Cargill's expertise in Asia and Südzucker's knowledge of sugar production to tap into the growing Chinese market for sugar-free products.

Südzucker's Zuckerforschung (sugar research) department: Focuses on developing new sugar-based ingredients, including sugar alcohols. They recently collaborated with the Fraunhofer Institute for Process Engineering and Packaging to improve the production of erythritol, a popular sugar alcohol.

Acquisition of BENEO-Palmy: In 2021, Südzucker acquired BENEO-Palmy, a Belgian company specializing in natural sweeteners, including sugar alcohols like isomaltose and erythritol. This move strengthens their sugar alcohols portfolio and expands their reach in the food and beverage industry.

- Südzucker's Zuckerforschung (sugar research) department: Focuses on developing new sugar-based ingredients, including sugar alcohols. They recently collaborated with the Fraunhofer Institute for Process Engineering and Packaging to improve the production of erythritol, a popular sugar alcohol.

- Acquisition of BENEO-Palmy: In 2021, Südzucker acquired BENEO-Palmy, a Belgian company specializing in natural sweeteners, including sugar alcohols like isomaltose and erythritol. This move strengthens their sugar alcohols portfolio and expands their reach in the food and beverage industry.

- Joint venture with Cargill: In 2022, Südzucker and Cargill established a joint venture to produce maltitol, another sugar alcohol, at a new plant in China. This venture leverages Cargill's expertise in Asia and Südzucker's knowledge of sugar production to tap into the growing Chinese market for sugar-free products.

Key Players :

- ADM (Archer Daniels Midland Company) (US)

- Cargill Incorporated (US)

- Ingredion Incorporated (US)

- Tate & Lyle (UK)

- DuPont (Denmark)

- Associated British Foods Plc (UK)

- Roquette Frères (France)

- Mitsubishi Corporation (Japan)

- International Flavors & Fragrances Inc. (US)

- Suedzucker AG (Germany)