Structural Adhesives Size

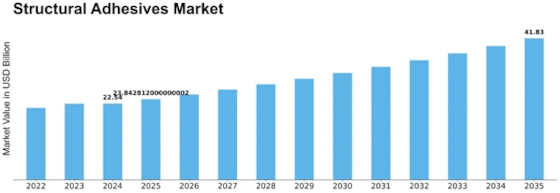

Structural Adhesives Market Growth Projections and Opportunities

A conjunction of basic elements applies a significant impact on the development and elements of the structural adhesives market. To keep up with seriousness and pursue very much educated choices in the unique underlying cements industry, organizations should have a complete comprehension of these elements. Request from the Car Business: The car business is a huge market driver for structural adhesives. The heightening interest for upgraded wellbeing, diminished weight, and further developed vehicle execution has provoked a more prominent usage of underlying cements in vehicular gathering. The usage of these cements upgrades the by and large underlying uprightness and life span of vehicles.

The rising pervasiveness of electric vehicles (EVs) adds to the thriving business sector interest for structural adhesives. The significance of lightweighting increments essentially as the car business shifts towards electric vehicles (EVs) to expand battery range. The improvement of electric vehicle weight and the holding of lightweight materials are both basic elements of structural adhesives. Applications in the Development Business: Primary cements are broadly used in the development business, explicitly for holding and fixing purposes. By working with the joining of materials in development projects, these cements work on primary honesty and grant life span, in this way becoming key parts of the business. Structural adhesives assume a basic part in the aviation and protection industry by working with the holding of lightweight materials, in this manner adding to weight decrease and further developed eco-friendliness. Cements that fulfill thorough execution models are of most extreme significance in the fields of airplane manufacture and guard execution. Progress in Holding Advances: The primary cements industry is pushed towards development by nonstop improvements in holding advancements. Associations that apportion assets towards innovative work fully intent on upgrading glue definitions, relieving periods, and bond strength can adjust to the changing requests of different areas. The market for structural adhesives is emphatically affected by the rising utilization of composite materials in assembling, especially in aviation and car applications. These glues add to the pattern of material expansion by being reasonable for holding a wide assortment of substances, including composites. The extension of the breeze energy industry, explicitly in the creation of wind turbine sharp edges, animates the requirement for primary cements. Cements are vital with regards to joining significant and low-weight components, subsequently upgrading the primary sufficiency and general viability of wind turbines. Natural Guidelines and an Emphasis on Manageability: As the significance of supportability increments, so does the interest in structural adhesives with earth harmless details. Associations that dispense assets towards the headway of glues that fulfill supportability principles and ecological guidelines can accomplish an upper hand. Worldwide Financial Patterns: The market is affected by the general monetary environment. Framework improvement, industrialization, and Gross domestic product development are financial elements that impact the interest for primary cements across a scope of end-use areas. Fathoming patterns and progressions in end-client areas, including however not restricted to the auto, aviation, development, and environmentally friendly power enterprises, is of fundamental significance for firms working inside the primary cements market. Manageable market achievement requires the capacity to conform to developing purchaser inclinations and industry requests.

Leave a Comment