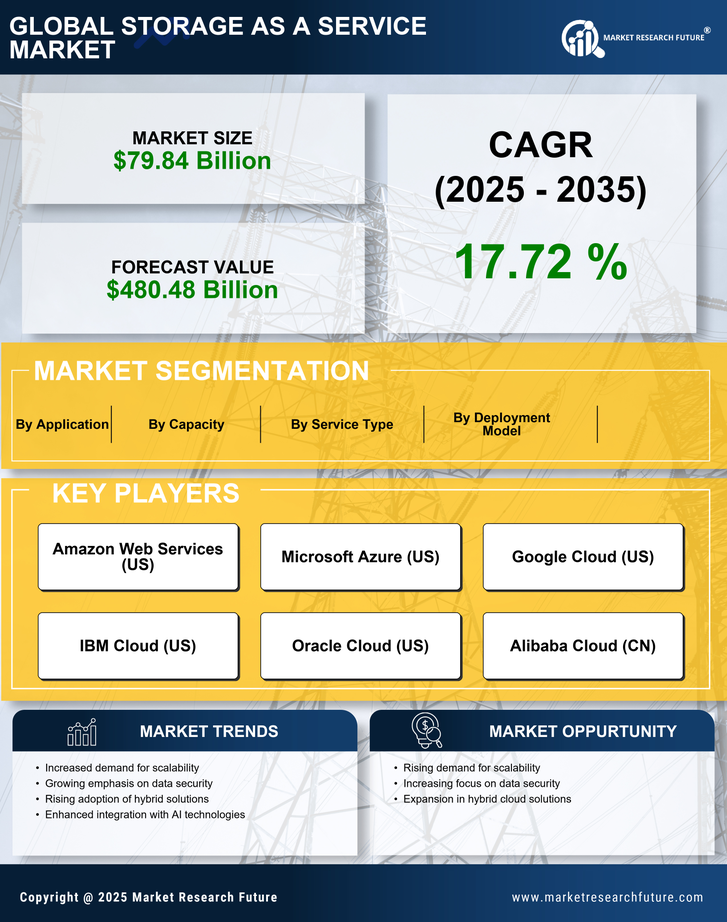

Increased Focus on Data Security

Data security is an ever-present concern for organizations, and this focus significantly influences the Storage As A Service Market. With the rise in cyber threats and data breaches, businesses are prioritizing secure storage solutions. Storage as a service providers are responding by implementing advanced security measures, including encryption, access controls, and compliance with industry regulations. According to industry reports, 60% of organizations cite data security as a primary factor in their decision to adopt cloud storage solutions. This heightened emphasis on security not only protects sensitive information but also fosters trust among clients and stakeholders. As organizations navigate the complexities of data protection, the increased focus on data security is likely to propel the growth of the Storage As A Service Market.

Rising Demand for Scalable Solutions

The Storage As A Service Market experiences a notable increase in demand for scalable storage solutions. Organizations are increasingly seeking flexible storage options that can grow alongside their data needs. This trend is driven by the exponential growth of data generated by businesses, which is projected to reach 175 zettabytes by 2025. As companies expand their operations and data requirements, the need for scalable storage solutions becomes paramount. Storage as a Service providers are responding by offering tiered storage options that allow businesses to pay only for what they use, thus optimizing costs. This adaptability not only enhances operational efficiency but also aligns with the dynamic nature of modern business environments. Consequently, the rising demand for scalable solutions is a key driver in the Storage As A Service Market.

Cost Efficiency and Budget Management

Cost efficiency remains a critical driver in the Storage As A Service Market. Organizations are increasingly looking to optimize their IT budgets, and adopting storage as a service offers a compelling solution. By shifting to a subscription-based model, businesses can avoid the substantial upfront costs associated with traditional storage solutions. This model allows for predictable budgeting, as companies only pay for the storage they utilize. According to recent data, organizations can save up to 30% on storage costs by leveraging cloud-based solutions. Furthermore, the reduction in maintenance and management overhead associated with on-premises storage systems contributes to overall cost savings. As financial prudence becomes a priority for many organizations, the cost efficiency offered by storage as a service is likely to drive its adoption in the Storage As A Service Market.

Adoption of Remote Work and Collaboration Tools

The shift towards remote work and collaboration tools has a profound impact on the Storage As A Service Market. As organizations embrace flexible work arrangements, the need for accessible and reliable storage solutions becomes critical. Storage as a service enables employees to access data from anywhere, facilitating seamless collaboration and productivity. Recent studies indicate that 74% of companies plan to permanently adopt remote work policies, underscoring the necessity for robust storage solutions that support this transition. Additionally, the integration of storage services with collaboration platforms enhances workflow efficiency. As remote work continues to gain traction, the adoption of storage as a service is likely to accelerate within the Storage As A Service Market.

Technological Advancements in Cloud Infrastructure

Technological advancements in cloud infrastructure are reshaping the Storage As A Service Market. Innovations such as edge computing, artificial intelligence, and machine learning are enhancing the capabilities of storage solutions. These technologies enable faster data processing, improved analytics, and more efficient data management. For instance, the integration of AI in storage solutions allows for predictive analytics, optimizing storage allocation and performance. As organizations increasingly rely on data-driven decision-making, the demand for advanced storage solutions is expected to rise. Furthermore, the continuous evolution of cloud technologies ensures that storage as a service remains competitive and relevant. As a result, technological advancements are a significant driver in the Storage As A Service Market.