Sustainability Initiatives

Sustainability initiatives are becoming increasingly pivotal within the Steel Cord Market. As environmental concerns gain prominence, manufacturers are adopting eco-friendly practices to minimize their carbon footprint. This includes the use of recycled materials in the production of steel cords, which not only conserves resources but also appeals to environmentally conscious consumers. Furthermore, regulatory frameworks are evolving, pushing companies to comply with stricter environmental standards. The market data indicates that companies investing in sustainable practices are likely to see a rise in demand, as consumers and businesses alike prioritize sustainability in their purchasing decisions. Consequently, the Steel Cord Market is poised for growth as it aligns with these sustainability trends.

Growth of the Automotive Sector

The growth of the automotive sector is a critical driver for the Steel Cord Market. As vehicle production ramps up, the demand for high-quality steel cords, which are essential for tire reinforcement, is also on the rise. The automotive industry is increasingly focusing on enhancing vehicle performance and safety, which necessitates the use of advanced materials like steel cords. Market data indicates that the automotive sector accounts for a substantial share of the overall steel cord consumption, and this trend is expected to continue as electric and hybrid vehicles become more prevalent. Consequently, the Steel Cord Market stands to gain significantly from the ongoing expansion of the automotive sector, as manufacturers strive to meet the growing requirements for durability and performance.

Rising Demand from Emerging Markets

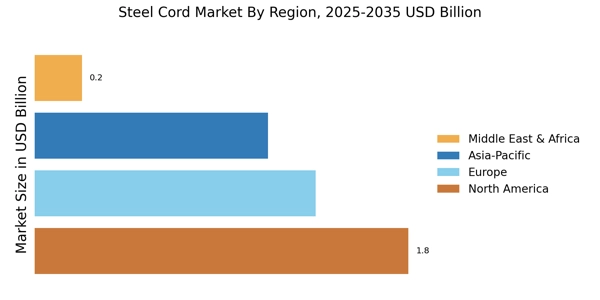

The Steel Cord Market is witnessing a surge in demand from emerging markets, particularly in regions experiencing rapid industrialization and urbanization. Countries in Asia and Africa are investing heavily in infrastructure development, which in turn drives the need for high-performance steel cords in various applications, including automotive and construction. Market data suggests that the demand for steel cords in these regions is expected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This trend presents significant opportunities for manufacturers to expand their operations and cater to the evolving needs of these markets. As a result, the Steel Cord Market is likely to benefit from this increasing demand, fostering innovation and competition.

Increasing Investment in Infrastructure

Increasing investment in infrastructure development is significantly influencing the Steel Cord Market. Governments and private entities are allocating substantial resources towards building roads, bridges, and other critical infrastructure, which in turn drives the demand for steel cords in construction applications. The need for durable and high-strength materials is paramount in these projects, making steel cords an essential component. Market data reveals that infrastructure spending is projected to rise, particularly in developing regions, leading to a corresponding increase in the consumption of steel cords. This trend suggests that the Steel Cord Market is well-positioned to capitalize on the growing infrastructure investments, thereby fostering growth and innovation within the sector.

Technological Advancements in Production

The Steel Cord Market is experiencing a notable transformation due to technological advancements in production processes. Innovations such as automated manufacturing and advanced quality control systems enhance efficiency and reduce production costs. For instance, the integration of Industry 4.0 technologies allows for real-time monitoring and predictive maintenance, which can lead to a reduction in downtime. As a result, manufacturers are able to produce high-quality steel cords that meet the stringent requirements of various applications, particularly in the tire industry. This shift towards more sophisticated production techniques is likely to drive growth in the Steel Cord Market, as companies seek to improve their competitive edge and respond to increasing consumer demands for quality and performance.