Increasing Energy Storage Needs

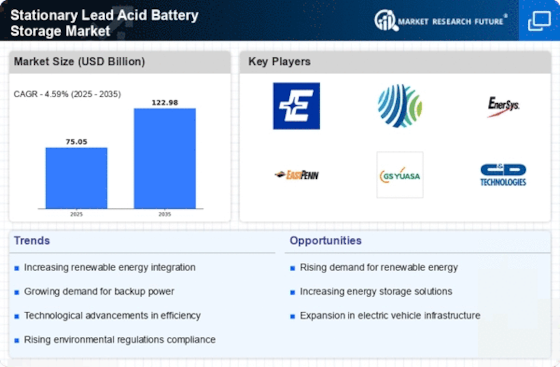

The Stationary Lead Acid Battery Storage Market is experiencing a surge in demand due to the increasing need for energy storage solutions. As energy consumption rises, particularly in urban areas, the necessity for reliable and efficient energy storage systems becomes paramount. This trend is further amplified by the integration of renewable energy sources, which often require robust storage solutions to manage supply and demand fluctuations. According to recent data, the energy storage market is projected to grow significantly, with stationary applications accounting for a substantial share. This growth is likely to drive investments in lead acid battery technologies, as they offer a cost-effective solution for energy storage, particularly in commercial and industrial applications.

Regulatory Incentives for Energy Storage

The Stationary Lead Acid Battery Storage Market is positively influenced by regulatory incentives aimed at promoting energy storage solutions. Governments across various regions are implementing policies that encourage the adoption of energy storage technologies, including lead acid batteries. These incentives may include tax credits, rebates, and grants for businesses and consumers who invest in energy storage systems. Such regulatory support not only enhances the financial viability of lead acid batteries but also aligns with broader sustainability goals. As these policies continue to evolve, they are expected to stimulate growth in the stationary lead acid battery market, fostering innovation and increasing market penetration.

Rising Demand for Backup Power Solutions

The Stationary Lead Acid Battery Storage Market is witnessing a rising demand for backup power solutions, particularly in sectors that require uninterrupted power supply. Industries such as telecommunications, healthcare, and data centers are increasingly relying on stationary lead acid batteries to ensure operational continuity during power outages. The reliability and established technology of lead acid batteries make them a preferred choice for backup applications. Market data indicates that the demand for backup power systems is expected to grow, driven by the increasing frequency of power disruptions and the need for resilient infrastructure. This trend is likely to bolster the stationary lead acid battery market as businesses seek dependable energy storage solutions.

Cost-Effectiveness of Lead Acid Batteries

The Stationary Lead Acid Battery Storage Market benefits from the cost-effectiveness of lead acid batteries compared to alternative technologies. These batteries are generally less expensive to manufacture and install, making them an attractive option for various applications, including backup power and renewable energy integration. The initial investment for lead acid batteries is often lower than that of lithium-ion batteries, which can encourage adoption among businesses and consumers alike. Furthermore, the longevity and reliability of lead acid batteries contribute to their overall value proposition. As the market continues to evolve, the affordability of lead acid batteries is likely to play a crucial role in their sustained demand within the energy storage sector.

Technological Innovations Enhancing Battery Efficiency

The Stationary Lead Acid Battery Storage Market is benefiting from ongoing technological innovations that enhance battery efficiency and performance. Advances in battery design, materials, and manufacturing processes are contributing to improved energy density, cycle life, and charging capabilities of lead acid batteries. These innovations are making lead acid batteries more competitive against newer technologies, such as lithium-ion batteries. As efficiency improves, the applications for stationary lead acid batteries expand, particularly in renewable energy storage and grid stabilization. The continuous evolution of battery technology is expected to drive further growth in the stationary lead acid battery market, as stakeholders seek to leverage these advancements for enhanced energy solutions.