Declining Costs of Battery Technologies

The Stationary Battery Storage Market is witnessing a significant decline in the costs associated with battery technologies. This reduction in prices is largely attributed to advancements in manufacturing processes and economies of scale. For instance, lithium-ion battery prices have decreased by approximately 85% since 2010, making them more accessible for various applications. This trend not only enhances the feasibility of stationary battery systems but also encourages widespread adoption across residential, commercial, and industrial sectors. As costs continue to fall, the market is likely to expand, attracting new investments and innovations in energy storage solutions.

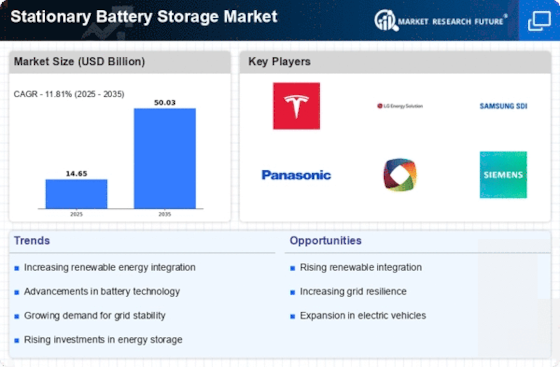

Rising Demand for Energy Storage Solutions

The Stationary Battery Storage Market is experiencing a notable surge in demand for energy storage solutions. This trend is primarily driven by the increasing need for reliable and efficient energy management systems. As energy consumption continues to rise, the necessity for storage solutions that can balance supply and demand becomes more pronounced. According to recent data, the energy storage capacity is projected to reach over 300 GWh by 2025, indicating a robust growth trajectory. This demand is further fueled by the proliferation of electric vehicles and the need for grid stability, which positions stationary battery storage as a critical component in modern energy infrastructure.

Growing Investment in Smart Grid Technologies

The Stationary Battery Storage Market is benefiting from the growing investment in smart grid technologies. These advancements facilitate better energy management and distribution, allowing for more efficient use of stationary battery storage systems. Smart grids enable real-time monitoring and control of energy flows, which enhances the effectiveness of battery storage solutions. As governments and private entities invest in modernizing grid infrastructure, the demand for stationary battery storage is likely to increase. This trend is indicative of a broader movement towards more resilient and adaptive energy systems that can respond to changing consumption patterns.

Supportive Government Policies and Incentives

The Stationary Battery Storage Market is significantly influenced by supportive government policies and incentives aimed at promoting energy storage solutions. Various governments are implementing regulations and financial incentives to encourage the adoption of stationary battery systems. These initiatives often include tax credits, grants, and subsidies that lower the financial barriers for consumers and businesses. As a result, the market is expected to expand as more stakeholders recognize the economic and environmental benefits of energy storage. Such policies not only stimulate market growth but also contribute to the overall transition towards sustainable energy systems.

Increased Focus on Renewable Energy Integration

The Stationary Battery Storage Market is increasingly influenced by the global shift towards renewable energy sources. As countries strive to meet ambitious climate goals, the integration of renewable energy into existing grids becomes essential. Stationary battery storage systems play a pivotal role in this transition by providing the necessary flexibility to store excess energy generated from renewable sources such as solar and wind. This integration not only enhances grid reliability but also supports the reduction of greenhouse gas emissions. The market for stationary battery storage is expected to grow significantly as utilities and energy providers seek to optimize their renewable energy portfolios.