Growing Demand for Energy Efficiency

The Global Static and Rotating Equipment Market Industry experiences a growing demand for energy-efficient solutions. Industries are increasingly focusing on reducing operational costs and minimizing environmental impact. This trend is evident in sectors such as oil and gas, where energy-efficient pumps and compressors are being adopted. The market is projected to reach 182.2 USD Billion in 2024, driven by the need for sustainable practices. Companies are investing in advanced technologies that enhance equipment performance while lowering energy consumption. This shift towards energy efficiency is likely to propel the market forward as organizations seek to comply with stringent regulations and improve their sustainability profiles.

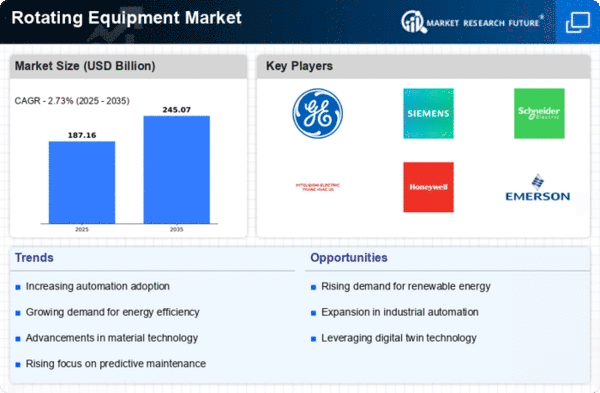

Market Trends and Growth Projections

The Global Static and Rotating Equipment Market Industry is characterized by various trends and growth projections. The market is anticipated to reach 182.2 USD Billion in 2024, with a steady increase expected as industries adapt to changing demands. By 2035, the market is projected to grow to 245.1 USD Billion, reflecting a robust CAGR of 2.73% from 2025 to 2035. These figures indicate a positive outlook for the industry, driven by factors such as technological advancements, regulatory compliance, and the increasing focus on energy efficiency. The market's trajectory suggests a dynamic environment where innovation and sustainability are paramount.

Increasing Investment in Renewable Energy

The increasing investment in renewable energy sources significantly impacts the Global Static and Rotating Equipment Market Industry. As countries transition towards sustainable energy solutions, there is a growing need for equipment that supports renewable energy generation. Wind turbines, solar power systems, and hydroelectric plants require specialized static and rotating equipment to operate efficiently. This shift is reflected in the rising capital allocated to renewable projects, which is expected to drive market growth. The focus on sustainability and reducing carbon footprints is likely to enhance the demand for innovative equipment solutions, positioning the market for substantial expansion in the coming years.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical factors influencing the Global Static and Rotating Equipment Market Industry. Governments worldwide are implementing stringent regulations to ensure safety and environmental protection. Industries such as manufacturing and energy are required to adhere to these regulations, which often necessitate the upgrade or replacement of existing equipment. For instance, compliance with emissions standards may lead to the adoption of more advanced compressors and turbines. This regulatory landscape drives investments in new technologies, thereby fostering market growth. As industries strive to meet these standards, the demand for reliable and compliant equipment is expected to rise, further propelling the market.

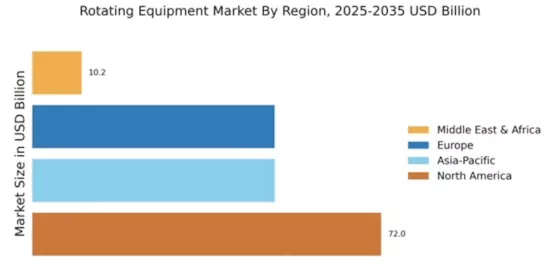

Infrastructure Development and Urbanization

Infrastructure development and urbanization are pivotal drivers of the Global Static and Rotating Equipment Market Industry. Rapid urbanization in emerging economies necessitates the construction of new facilities, which in turn increases the demand for static and rotating equipment. For example, the expansion of water treatment plants and power generation facilities requires pumps, turbines, and compressors. This trend is particularly pronounced in regions experiencing significant population growth. As urban centers expand, the market is likely to benefit from increased investments in infrastructure, contributing to a projected CAGR of 2.73% from 2025 to 2035, reflecting the ongoing need for reliable equipment in these projects.

Technological Advancements in Equipment Design

Technological advancements play a crucial role in shaping the Global Static and Rotating Equipment Market Industry. Innovations in materials and design methodologies have led to the development of more reliable and efficient equipment. For instance, the integration of smart technologies and IoT capabilities allows for real-time monitoring and predictive maintenance, reducing downtime and enhancing productivity. As industries adopt these advanced solutions, the market is expected to grow significantly, with projections indicating a rise to 245.1 USD Billion by 2035. These advancements not only improve operational efficiency but also contribute to the overall competitiveness of businesses in various sectors.