Stainless Steel Cable Ties Size

Stainless Steel Cable Ties Market Growth Projections and Opportunities

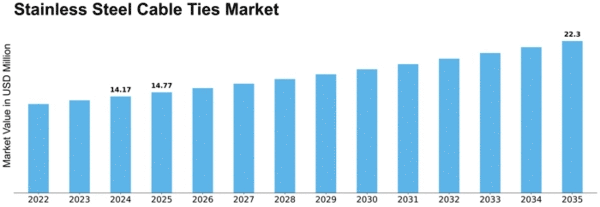

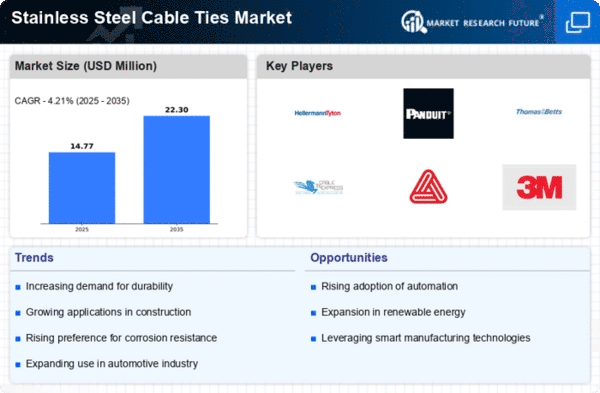

The worldwide market for stainless-steel cable ties reached a value of USD 184,736.6 thousand in 2017 and is anticipated to achieve USD 220,990.5 thousand by 2023, growing at a rate of 3.12%. In volume terms, the global market was 124,157 thousand tons in 2017 and is predicted to experience a Compound Annual Growth Rate (CAGR) of 2.18% throughout the forecast period. The expansion of the global stainless-steel cable ties market is driven by various factors, including the increased utilization of these ties in transportation for securing exhaust heat wrap in motorcycles, trucks, automobiles, and railways. Additionally, their application has surged in the oil & gas sector, where they are used to tie electrical or communication cabling to cable trays in demanding environments at oil rigs and refineries. Furthermore, the recovery of the global economy and the swift industrialization in the Asia-Pacific region are anticipated to contribute to the growth of the global stainless-steel cable ties market.

The global stainless-steel cable ties market is categorized based on type, application, and region. Regarding type, the market is segmented into uncoated stainless-steel cable ties and coated stainless-steel cable ties. In 2017, uncoated stainless-steel cable ties held the larger market share by value at 54.9%, amounting to USD 101,503.0 thousand. This segment is anticipated to continue dominating with a value share of 54.6% by 2023, primarily due to its cost-effectiveness compared to coated stainless-steel cable ties. In terms of volume, uncoated stainless-steel cable ties reached 83,115 thousand units in 2017 and are projected to reach 93,461 thousand units by 2023. The market for coated stainless-steel cable ties was valued at USD 83,233.7 thousand in 2017 and is estimated to register a higher CAGR of 3.26% during the forecast period, reaching USD 100,340.6 thousand by 2023. The superior protection against corrosion and environmental conditions attributed to coatings is expected to drive increased demand.

Application-wise, the global stainless-steel cable ties market is segmented into transportation, marine, oil & gas exploration, chemicals, construction, mining, electronics, and others. The transportation segment held the largest market share by value at 35.1% in 2017, reaching USD 64,847.8 thousand. It is projected to exhibit the highest CAGR of 3.42%, reaching USD 78,939.7 thousand by 2023. In terms of volume, the market was sized at 43,588 thousand units in 2017 and is expected to reach 50,250 thousand units by 2023. Stainless-steel cable ties play a crucial role in fastening and securing the insulation board of automobile exhaust pipes, driveshaft dust covers, brake buses, airbags, water inlet/outlet pipes, and air pipes in vehicles. This application ensures effective sealing, safety, and reliability of pipelines, driving increased demand in the transportation sector.

Regionally, the global stainless-steel cable ties market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2017, Asia-Pacific held the largest market share at 40.2%, amounting to USD 74,185.1 thousand. The regional market is anticipated to maintain dominance, accounting for 41.1% by the end of 2023, with an estimated market value of USD 90,825.5 thousand. The rapid industrialization in the Asia-Pacific region is expected to be a key factor fueling the demand for stainless-steel cable ties during the forecast period.

Leave a Comment