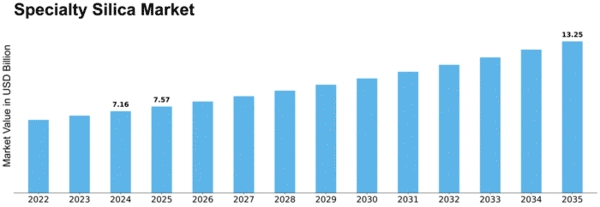

Specialty Silica Size

Specialty Silica Market Growth Projections and Opportunities

The Specialty Silica Market is influenced by many important things that affect its growth and movement. Knowing these things well is important for businesses doing work with special silica. They need to make smart choices and stay ahead in a market that keeps changing. The automobile business is a big part of the special silica market. Silica is often used as a strengthening material in making tires. It helps improve how well they stick to the road, use less fuel and perform better overall. The increase in need for tires that use less fuel and have good performance affects the special silica market a lot. The growing number of cars worldwide is causing a higher need for tires. Specialty silica helps make tires better in two ways - rolling resistance and wet hugging. This makes it very important for making tires. As more tires are produced, this is good news for the specialty silico market too. The use of special green tire tech that focuses on both sustainability and lower impact on the environment is a major habit in markets for silica. Silica, used as a strengthening powder in tires helps make them use less gas while rolling. This makes cars more fuel-efficient and pleases those who care about the environment. As more people become aware of the environment, there is a growing attention on creating new renewable and bio-based sources for silica. Companies that spend money on research and make special silica from green places like rice husks or bamboo will probably do better than others in the market. The building business uses a lot of special silica, especially for strong concrete. The need for strong and long-lasting building things, where silica is a main extra ingredient, impacts the market as worldwide construction activities grow. Specialized silica is used in electronics and electrical work. It is added to materials that cover things, gooey stuff, and sticky glue.

Leave a Comment