Rising Demand in Construction Sector

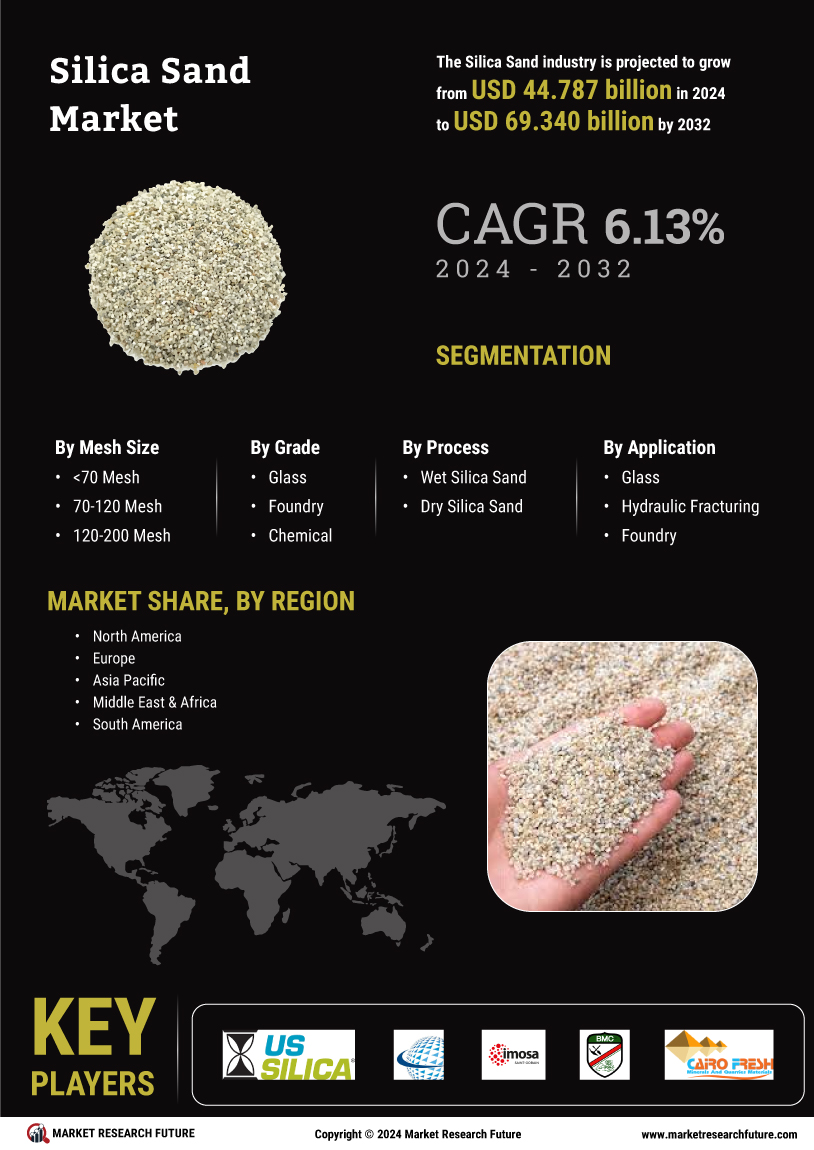

The construction sector is experiencing a notable surge in demand for silica sand, primarily due to its essential role in concrete production and glass manufacturing. As urbanization accelerates, the need for infrastructure development increases, thereby driving the silica sand market. In 2025, the construction industry is projected to grow at a compound annual growth rate of approximately 5.5%, which directly correlates with the rising consumption of silica sand. This trend indicates that the silica sand market is likely to benefit significantly from ongoing and upcoming construction projects, as silica sand is a critical component in various construction materials. Furthermore, the increasing focus on sustainable building practices may further enhance the demand for high-quality silica sand, as builders seek materials that meet environmental standards.

Technological Innovations in Extraction

Technological advancements in the extraction and processing of silica sand are transforming the silica sand market. Innovations such as automated mining techniques and advanced sorting technologies are enhancing efficiency and reducing operational costs. These developments not only improve the quality of the extracted silica sand but also increase the overall yield, making it more economically viable for producers. In 2025, it is estimated that the adoption of these technologies could lead to a 15% increase in production efficiency. As companies invest in modern equipment and processes, the silica sand market is likely to witness a shift towards more sustainable and cost-effective practices, which could attract new entrants and stimulate competition within the market.

Regulatory Support for Mining Activities

Regulatory frameworks that support mining activities are playing a crucial role in shaping the silica sand market. Governments are increasingly recognizing the economic benefits of silica sand extraction, leading to policies that facilitate mining operations while ensuring environmental protection. In 2025, it is anticipated that several regions will implement streamlined permitting processes, which could reduce the time and costs associated with starting new mining projects. This regulatory support may encourage investment in the silica sand market, as companies seek to capitalize on favorable conditions. Moreover, adherence to environmental regulations may also drive innovation in sustainable mining practices, further enhancing the industry's reputation and marketability.

Expanding Applications in Industrial Sectors

The versatility of silica sand is leading to its expanding applications across various industrial sectors, thereby propelling the silica sand market. Beyond traditional uses in construction and glass manufacturing, silica sand is increasingly utilized in foundries, oil and gas extraction, and even in the production of silicon for electronics. In 2025, the demand for silica sand in the oil and gas sector is expected to rise by approximately 10%, driven by the need for hydraulic fracturing. This diversification of applications suggests that the silica sand market is not only resilient but also adaptable to changing industrial needs, potentially leading to new market opportunities and revenue streams for producers.

Growing Awareness of Environmental Sustainability

The growing awareness of environmental sustainability is influencing the silica sand market, as consumers and businesses alike prioritize eco-friendly practices. This trend is prompting manufacturers to seek sustainably sourced silica sand, which is produced with minimal environmental impact. In 2025, it is projected that the demand for sustainably sourced silica sand will increase by 20%, as industries strive to meet corporate social responsibility goals. This shift towards sustainability may lead to the development of new standards and certifications within the silica sand market, encouraging producers to adopt greener practices. Consequently, this focus on sustainability could enhance the competitive landscape, as companies that prioritize environmental stewardship may gain a significant advantage in the marketplace.