Enhanced Security Features

Security concerns are paramount in the telecommunications sector, and the virtualized evolved-packet-core market in Spain is responding to this challenge with enhanced security features. As cyber threats evolve, operators are compelled to adopt solutions that offer robust security measures. Virtualized architectures can provide advanced security protocols, including network slicing and segmentation, which are essential for protecting sensitive data. The market is likely to see a growing emphasis on security as a differentiator, with operators investing in solutions that not only meet regulatory requirements but also build customer trust.

Support for Emerging Technologies

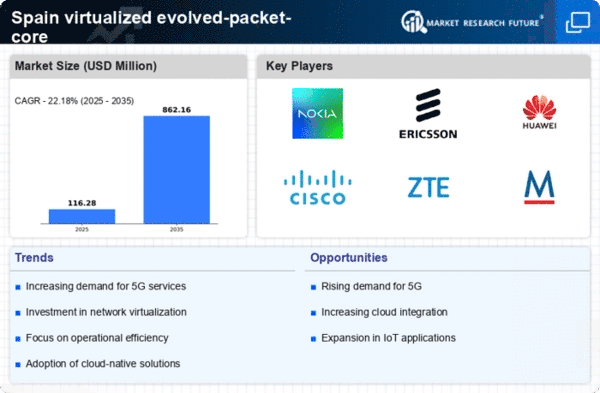

The virtualized evolved-packet-core market in Spain is increasingly driven by the need to support emerging technologies such as 5G and edge computing. These technologies require a flexible and efficient core network to deliver high-speed connectivity and low latency. As Spain continues to invest in 5G infrastructure, the demand for virtualized solutions that can seamlessly integrate with these technologies is expected to rise. The market is poised for growth as operators seek to leverage virtualization to enhance their service offerings and meet the demands of next-generation applications.

Regulatory Incentives for Innovation

Regulatory frameworks in Spain are evolving to foster innovation within the telecommunications sector, significantly impacting the virtualized evolved-packet-core market. Government initiatives aimed at promoting digital transformation are likely to provide incentives for operators to adopt virtualized solutions. These incentives may include financial support or streamlined processes for deploying new technologies. As a result, the market is expected to benefit from increased investment and innovation, as operators align their strategies with regulatory goals that encourage modernization and competitiveness.

Rising Demand for Network Flexibility

The virtualized evolved-packet-core market in Spain is experiencing a notable surge in demand for network flexibility. As businesses and service providers seek to adapt to rapidly changing market conditions, the ability to scale network resources dynamically becomes essential. This flexibility allows operators to optimize their infrastructure, reducing operational costs by up to 30%. Furthermore, the increasing reliance on mobile applications and IoT devices necessitates a robust and adaptable network architecture. The virtualized evolved-packet-core market is thus positioned to benefit from this trend, as it enables operators to deploy services more efficiently and respond to customer needs with agility.

Cost Efficiency through Virtualization

Cost efficiency remains a critical driver for the virtualized evolved-packet-core market in Spain. By transitioning to virtualized solutions, operators can significantly reduce capital expenditures associated with traditional hardware. Reports indicate that companies can save approximately 25% on infrastructure costs by adopting virtualized technologies. This shift not only lowers the barrier to entry for new players in the telecommunications sector but also allows existing operators to reallocate resources towards innovation and service enhancement. The virtualized evolved-packet-core market is thus likely to see increased investment as organizations recognize the financial benefits of virtualization.