Supportive Regulatory Framework

The regulatory environment in Spain is increasingly supportive of the development and commercialization of gene therapies, which is a crucial driver for the Spain viral vectors plasmid DNA manufacturing market. The Spanish Agency of Medicines and Medical Devices (AEMPS) has established guidelines that facilitate the approval process for gene therapies, thereby encouraging investment in this sector. This regulatory support not only enhances the credibility of the manufacturing processes but also ensures compliance with safety and efficacy standards. As a result, companies operating within the Spain viral vectors plasmid DNA manufacturing market are likely to experience accelerated growth due to streamlined regulatory pathways that promote innovation and market entry.

Growing Demand for Gene Therapies

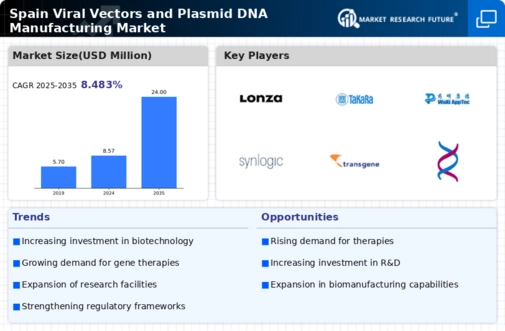

The Spain viral vectors plasmid DNA manufacturing market is experiencing a notable increase in demand for gene therapies. This surge is driven by advancements in genetic research and the rising prevalence of genetic disorders. According to recent data, the market for gene therapies in Spain is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is likely to stimulate the need for efficient manufacturing processes of viral vectors and plasmid DNA, as these are critical components in the development of gene therapies. As healthcare providers and pharmaceutical companies seek innovative treatment options, the Spain viral vectors plasmid DNA manufacturing market is positioned to benefit significantly from this trend.

Rising Investment in Biotechnology Startups

The Spain viral vectors plasmid DNA manufacturing market is witnessing a surge in investment directed towards biotechnology startups. Venture capital firms and government initiatives are increasingly funding innovative companies focused on gene therapy and related technologies. This influx of capital is likely to foster research and development activities, leading to the emergence of novel therapeutic solutions. As startups develop new applications for viral vectors and plasmid DNA, the overall landscape of the Spain viral vectors plasmid DNA manufacturing market is expected to evolve, creating new opportunities for collaboration and growth.

Technological Advancements in Manufacturing

Technological innovations in the manufacturing processes of viral vectors and plasmid DNA are significantly impacting the Spain viral vectors plasmid DNA manufacturing market. The introduction of automated systems and advanced bioprocessing techniques has improved production efficiency and scalability. For instance, the adoption of single-use bioreactors has reduced contamination risks and operational costs, making it easier for manufacturers to meet the increasing demand for high-quality products. As these technologies continue to evolve, they are expected to enhance the overall productivity of the Spain viral vectors plasmid DNA manufacturing market, allowing companies to respond more effectively to market needs.

Increased Collaboration Between Research Institutions and Industry

Collaboration between research institutions and the private sector is becoming a prominent driver in the Spain viral vectors plasmid DNA manufacturing market. Universities and research centers are partnering with biotechnology companies to advance the development of gene therapies. These collaborations often result in the sharing of knowledge, resources, and technology, which can accelerate the manufacturing processes of viral vectors and plasmid DNA. As these partnerships grow, they are likely to enhance the innovation capacity of the Spain viral vectors plasmid DNA manufacturing market, ultimately leading to more effective and efficient therapeutic solutions.