Rising Incidence of Liver Cancer

The market is experiencing growth due to the increasing incidence of liver cancer. According to recent statistics, liver cancer cases have risen by approximately 3.5% annually in Spain, necessitating effective treatment options. Transarterial chemoembolization (TACE) is recognized as a minimally invasive procedure that offers a viable alternative for patients who are not candidates for surgical resection. The rising prevalence of liver cancer, particularly among older populations, is likely to drive demand for TACE procedures. Furthermore, the Spanish healthcare system is adapting to these trends by allocating more resources to interventional radiology, thereby enhancing the availability of TACE. This shift indicates a growing recognition of TACE's role in managing liver cancer, which could further bolster the transarterial chemoembolization market in Spain.

Advancements in Imaging Techniques

Innovations in imaging technologies are significantly impacting the transarterial chemoembolization market in Spain. Enhanced imaging modalities, such as MRI and CT scans, allow for more precise tumor localization and better assessment of liver lesions. These advancements facilitate improved patient selection for TACE, ensuring that only those who will benefit from the procedure undergo treatment. The integration of advanced imaging techniques into clinical practice has been shown to increase the success rates of TACE, with studies indicating a potential improvement in overall survival rates by up to 20%. As healthcare providers in Spain continue to adopt these technologies, the transarterial chemoembolization market is likely to expand, driven by the demand for more effective and targeted treatment options.

Supportive Clinical Guidelines and Protocols

The transarterial chemoembolization market in Spain is being positively influenced by the establishment of supportive clinical guidelines and protocols. Professional medical societies have developed comprehensive guidelines that endorse TACE as a standard treatment option for patients with unresectable liver tumors. These guidelines not only provide a framework for clinicians but also enhance the credibility of TACE within the medical community. As adherence to these protocols increases, it is expected that more healthcare providers will incorporate TACE into their treatment regimens. This trend is likely to result in a higher volume of TACE procedures performed, thereby expanding the transarterial chemoembolization market in Spain as clinicians align their practices with established recommendations.

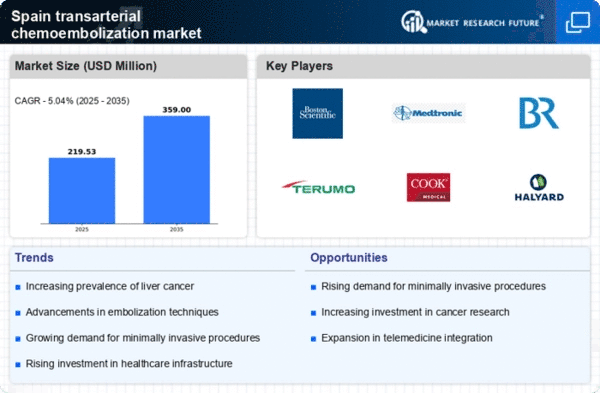

Growing Investment in Healthcare Infrastructure

The market is benefiting from increased investment in healthcare infrastructure. The Spanish government has committed to enhancing healthcare facilities, particularly in the realm of oncology and interventional radiology. This investment is expected to improve access to TACE procedures, as more hospitals and clinics are equipped with the necessary technology and trained personnel. Reports suggest that healthcare spending in Spain is projected to grow by approximately 5% annually, with a significant portion allocated to cancer treatment services. This trend indicates a robust commitment to improving patient outcomes, which is likely to positively influence the transarterial chemoembolization market as more patients gain access to this effective treatment modality.

Patient Preference for Minimally Invasive Procedures

There is a notable shift in patient preferences towards minimally invasive procedures, which is positively influencing the transarterial chemoembolization market in Spain. Patients are increasingly seeking treatment options that offer shorter recovery times and reduced hospital stays. TACE, being a minimally invasive procedure, aligns well with these preferences, as it typically requires only local anesthesia and allows for outpatient treatment. Surveys indicate that over 70% of patients express a preference for procedures that minimize surgical risks and recovery time. This growing inclination towards less invasive options is likely to drive the demand for TACE, as healthcare providers in Spain adapt to meet patient expectations and improve overall satisfaction with cancer treatment.