Growing Awareness of Patient Safety

The surgical navigation-systems market is benefiting from an increasing awareness of patient safety among healthcare professionals and patients alike. As surgical errors can lead to severe complications, the emphasis on minimizing risks has led to a greater adoption of navigation systems that enhance surgical precision. Surveys indicate that over 70% of surgeons in Spain believe that navigation systems significantly reduce the likelihood of errors during complex procedures. This heightened focus on patient safety is driving hospitals to invest in surgical navigation technologies, thereby propelling the market forward. The surgical navigation-systems market is likely to continue expanding as the healthcare community prioritizes safety and efficacy in surgical practices.

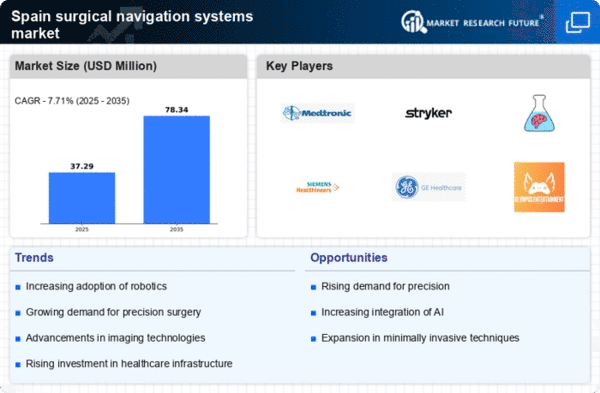

Rising Demand for Precision Surgery

The surgical navigation-systems market in Spain is experiencing a notable increase in demand for precision surgery. Surgeons and healthcare providers are increasingly recognizing the benefits of enhanced accuracy and reduced complications associated with these systems. The integration of advanced imaging technologies, such as MRI and CT scans, into surgical navigation systems allows for real-time guidance during procedures. This trend is reflected in the growing number of surgical procedures utilizing navigation systems, which has reportedly increased by 15% over the past year. As hospitals and surgical centers invest in these technologies, the surgical navigation-systems market is likely to expand further, driven by the need for improved patient outcomes and operational efficiency.

Technological Integration with Robotics

The integration of surgical navigation systems with robotic-assisted surgery is emerging as a key driver in the surgical navigation-systems market. In Spain, the adoption of robotic systems in surgical procedures has been on the rise, with hospitals increasingly utilizing these technologies to enhance surgical precision and efficiency. The combination of navigation systems with robotic platforms allows for improved visualization and control during operations. This synergy is expected to boost the surgical navigation-systems market, as more healthcare facilities recognize the advantages of combining these technologies. As the trend towards robotic surgery continues, the surgical navigation-systems market is likely to see substantial growth in the coming years.

Expansion of Training Programs for Surgeons

The surgical navigation-systems market is also being driven by the expansion of training programs for surgeons in Spain. As the complexity of surgical procedures increases, there is a growing need for specialized training in the use of navigation systems. Medical institutions are developing comprehensive training modules that focus on the effective use of these technologies, which is essential for maximizing their benefits. Reports suggest that the number of training programs has increased by 20% in the last year, reflecting the commitment to enhancing surgical skills. This focus on education is likely to foster greater adoption of surgical navigation systems, thereby contributing to the overall growth of the market.

Increased Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure is significantly impacting the surgical navigation-systems market. The government has allocated substantial funding towards modernizing hospitals and surgical facilities, which includes the acquisition of advanced surgical navigation systems. Reports indicate that healthcare spending in Spain is projected to grow by 5% annually, with a significant portion directed towards surgical technologies. This investment not only facilitates the adoption of innovative surgical navigation systems but also encourages research and development in this field. Consequently, the surgical navigation-systems market is poised for growth as healthcare providers seek to improve surgical outcomes and patient safety through state-of-the-art technologies.