Supportive Regulatory Environment

The regulatory landscape in Spain is becoming increasingly supportive of the structural heart-devices market. Recent initiatives by health authorities aim to streamline the approval process for innovative medical devices, thereby facilitating quicker access to the market. This regulatory support is crucial for manufacturers looking to introduce new products, as it reduces the time and costs associated with bringing devices to market. Additionally, reimbursement policies are evolving to cover a broader range of structural heart devices, making them more accessible to patients. As the regulatory environment continues to improve, it is likely to encourage investment and innovation within the structural heart-devices market, ultimately benefiting patient care.

Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure significantly impacts the structural heart-devices market. The government has allocated substantial funding to improve hospital facilities and expand access to advanced medical technologies. This investment is expected to facilitate the adoption of innovative structural heart devices, as hospitals become better equipped to perform complex procedures. Additionally, the establishment of specialized cardiac centers across the country is likely to increase the availability of these devices, making them more accessible to patients. With an estimated €1.5 billion earmarked for healthcare improvements in the coming years, the structural heart-devices market is poised for growth as healthcare providers adopt cutting-edge technologies to meet patient needs.

Growing Awareness and Education Initiatives

The increasing awareness of heart health and the importance of early intervention is driving the structural heart-devices market in Spain. Educational campaigns aimed at both healthcare professionals and the general public are crucial in promoting the benefits of these devices. As more individuals become informed about the risks associated with untreated structural heart conditions, the demand for timely diagnosis and treatment options is likely to rise. Furthermore, training programs for healthcare providers on the latest advancements in structural heart devices are essential for ensuring proper implementation and patient care. This heightened awareness and education are expected to contribute positively to the growth of the structural heart-devices market, as patients seek out these innovative solutions.

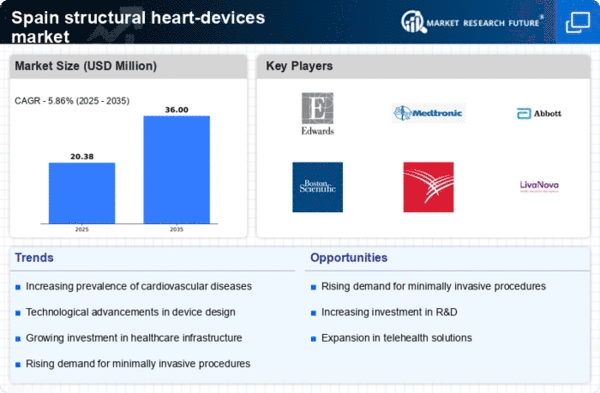

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in Spain is a primary driver for the structural heart-devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced treatment options, including structural heart devices, to manage conditions such as heart valve disorders and congenital heart defects. The growing awareness among healthcare professionals and patients regarding the benefits of these devices is likely to further stimulate market growth. As the population ages, the demand for effective interventions is expected to increase, thereby propelling the structural heart-devices market forward. Furthermore, the integration of these devices into standard treatment protocols may enhance patient outcomes, making them a preferred choice for both physicians and patients alike.

Technological Innovations in Device Functionality

Technological advancements in the functionality of structural heart devices are a significant driver of market growth in Spain. Innovations such as bioresorbable materials, advanced imaging techniques, and improved delivery systems enhance the effectiveness and safety of these devices. The introduction of devices that can be implanted with minimal invasiveness is particularly appealing to both patients and healthcare providers. As these technologies evolve, they are likely to expand the range of treatable conditions, thereby increasing the overall market potential. The structural heart-devices market is expected to benefit from ongoing research and development efforts, which aim to create devices that offer better outcomes and reduced recovery times for patients.