Advancements in Imaging Technologies

The evolution of imaging technologies plays a crucial role in the structural heart-devices market. Enhanced imaging modalities, such as 3D echocardiography and cardiac MRI, facilitate precise diagnosis and treatment planning for structural heart conditions. These advancements enable healthcare professionals to visualize complex anatomical structures, leading to improved procedural outcomes. As imaging technologies become more integrated into clinical practice, they are likely to drive the adoption of structural heart devices. The ability to accurately assess heart conditions allows for better patient selection and device placement, which is essential for successful interventions. Consequently, the structural heart-devices market may witness increased demand as healthcare facilities invest in state-of-the-art imaging solutions to complement their therapeutic offerings.

Rising Awareness and Education Initiatives

There is a growing awareness of heart health among the South Korean population, which is positively influencing the structural heart-devices market. Educational campaigns aimed at informing the public about cardiovascular diseases and available treatment options are becoming more prevalent. As individuals become more knowledgeable about their health, they are more likely to seek medical attention for heart-related issues. This increased awareness is driving demand for structural heart devices, as patients are more inclined to explore advanced treatment options. Healthcare providers are also focusing on educating their staff about the latest technologies, which may further enhance the adoption of these devices in clinical practice. The structural heart-devices market could see a notable uptick in demand as a result of these initiatives.

Collaboration Between Industry and Academia

Collaborative efforts between industry stakeholders and academic institutions are fostering innovation in the structural heart-devices market. Research partnerships are leading to the development of novel devices and techniques that address unmet clinical needs. These collaborations often result in clinical trials that validate the efficacy and safety of new products, thereby accelerating their entry into the market. As universities and research organizations work closely with manufacturers, the pace of innovation is likely to increase, providing healthcare professionals with more effective tools for treating structural heart conditions. This synergy may contribute to a robust growth trajectory for the structural heart-devices market, with potential advancements expected to emerge in the next few years.

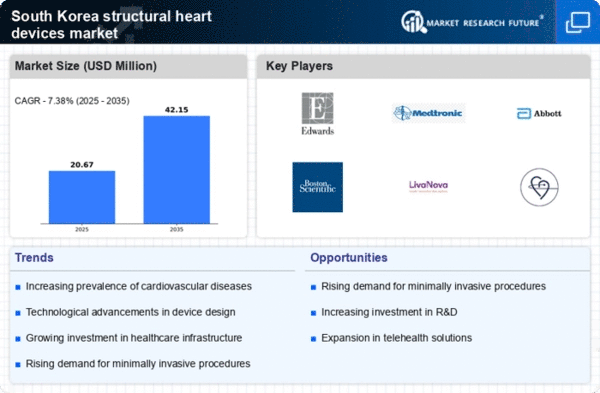

Growing Investment in Healthcare Infrastructure

The South Korean government's commitment to enhancing healthcare infrastructure significantly impacts the structural heart-devices market. Increased funding for hospitals and medical facilities aims to improve access to advanced medical technologies. This investment is likely to facilitate the acquisition of cutting-edge structural heart devices, thereby expanding treatment options for patients. Furthermore, the establishment of specialized cardiac centers is expected to enhance the quality of care provided to individuals with heart conditions. As healthcare infrastructure continues to develop, the structural heart-devices market may experience accelerated growth, with projections indicating a potential increase in market size by 15% over the next five years.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in South Korea is a primary driver for the structural heart-devices market. According to health statistics, cardiovascular diseases account for a significant portion of mortality rates, prompting a growing need for effective treatment options. The demand for innovative devices that can address conditions such as heart valve disorders and congenital heart defects is escalating. This trend is further supported by an aging population, which is more susceptible to heart-related ailments. As healthcare providers seek to improve patient outcomes, investments in advanced structural heart devices are likely to increase. The structural heart-devices market is expected to expand as hospitals and clinics adopt these technologies to enhance their treatment capabilities, potentially leading to a market growth rate of over 10% annually in the coming years.