Increased Cloud Adoption

The rapid adoption of cloud technologies in Spain is a significant driver for the software defined-perimeter market. As businesses migrate to cloud environments, they face new security challenges that necessitate advanced protective measures. The software defined-perimeter model offers a flexible and scalable approach to securing cloud resources, making it an attractive option for organizations. By 2025, it is projected that over 70% of Spanish enterprises will utilize cloud services, creating a substantial demand for software defined-perimeter solutions. This trend indicates a shift in how organizations approach security, emphasizing the need for integrated solutions that can adapt to evolving cloud landscapes.

Shift Towards Remote Work

The transition to remote work has significantly influenced the software defined-perimeter market in Spain. As organizations adapt to flexible work arrangements, the need for secure access to corporate resources from various locations has surged. This shift has led to an increased reliance on software defined-perimeter solutions, which provide secure connectivity and protect against potential vulnerabilities. In 2025, it is anticipated that remote work will account for approximately 30% of the workforce in Spain, further driving the demand for robust security measures. Companies are recognizing that traditional perimeter defenses are insufficient, thus propelling the software defined-perimeter market as a vital solution for ensuring secure remote access.

Rising Cybersecurity Threats

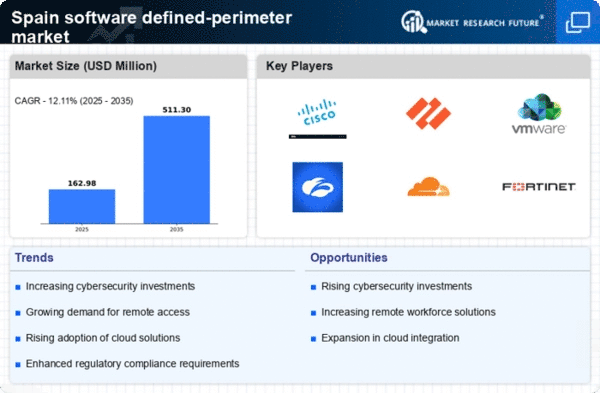

The software defined-perimeter market in Spain is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt advanced security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting Spanish companies to invest in software defined-perimeter solutions. This market is projected to grow at a CAGR of 20% as firms seek to mitigate risks associated with data breaches and unauthorized access. The urgency to safeguard digital assets is driving the demand for innovative security frameworks, making the software defined-perimeter market a critical component of Spain's cybersecurity strategy.

Growing Awareness of Data Privacy

The increasing awareness of data privacy among consumers and businesses in Spain is influencing the software defined-perimeter market. As individuals become more conscious of their personal information and its security, organizations are compelled to enhance their data protection strategies. This heightened awareness is driving demand for software defined-perimeter solutions that offer robust security features and ensure compliance with privacy regulations. In 2025, it is estimated that 60% of Spanish consumers will prioritize data privacy when choosing service providers, prompting companies to invest in advanced security measures. The software defined-perimeter market is thus positioned to benefit from this growing emphasis on data privacy and protection.

Regulatory Pressures and Compliance

In Spain, regulatory pressures are shaping the software defined-perimeter market as organizations strive to comply with stringent data protection laws. The General Data Protection Regulation (GDPR) mandates strict guidelines for data handling, compelling businesses to implement comprehensive security measures. As of 2025, non-compliance can result in fines up to €20 million or 4% of annual global turnover, which incentivizes firms to invest in software defined-perimeter solutions. This market is expected to expand as organizations prioritize compliance and seek to avoid costly penalties. The intersection of regulatory requirements and security needs is driving innovation and adoption within the software defined-perimeter market.