Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in South Korea is creating new challenges and opportunities for the software defined-perimeter market. As more devices connect to corporate networks, the potential attack surface expands, necessitating robust security measures. Software defined-perimeter solutions are well-suited to address these challenges by providing secure access and segmentation for IoT devices. In 2025, it is projected that the number of connected IoT devices in South Korea will exceed 1 billion, highlighting the urgent need for effective security frameworks. This growth is likely to drive the software defined-perimeter market as organizations seek to protect their networks from vulnerabilities associated with IoT integration.

Shift to Remote Work Models

The transition to remote work has significantly influenced the software defined-perimeter market in South Korea. As organizations adapt to flexible work arrangements, the need for secure access to corporate resources from various locations has surged. This shift has led to an increased reliance on software defined-perimeter solutions, which provide secure connectivity and protect against unauthorized access. In 2025, it is projected that remote work will account for over 30% of the workforce in South Korea, further driving the demand for robust security measures. The software defined-perimeter market is thus positioned to expand as companies prioritize secure remote access to maintain productivity and protect sensitive information.

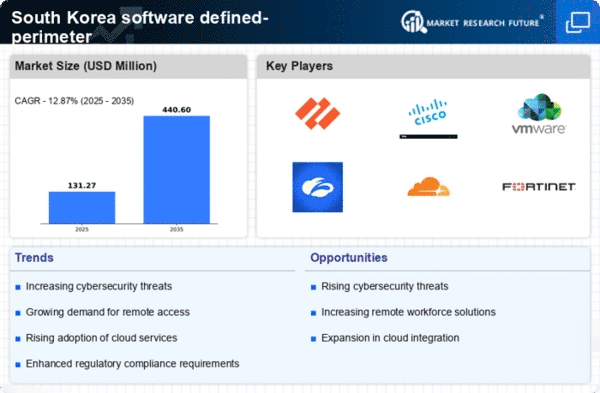

Rising Cybersecurity Threats

The software defined-perimeter market is experiencing growth due to the increasing frequency and sophistication of cyber threats in South Korea. Organizations are compelled to adopt advanced security measures to protect sensitive data and infrastructure. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting South Korean enterprises to invest in software defined-perimeter solutions. This market segment is expected to grow at a CAGR of approximately 20% as businesses seek to mitigate risks associated with data breaches and unauthorized access. The urgency to safeguard digital assets is driving the demand for innovative security frameworks, making the software defined-perimeter market a critical component of South Korea's cybersecurity strategy.

Increased Regulatory Pressures

The software defined-perimeter market is influenced by the rising regulatory pressures in South Korea, particularly concerning data protection and privacy. With the implementation of stringent regulations, such as the Personal Information Protection Act (PIPA), organizations are required to adopt comprehensive security measures to ensure compliance. This regulatory landscape is driving the demand for software defined-perimeter solutions, which offer enhanced security features and access controls. In 2025, it is expected that compliance-related investments will constitute a significant portion of IT budgets, further fueling the growth of the software defined-perimeter market. Organizations are increasingly recognizing the importance of aligning their security strategies with regulatory requirements to avoid penalties and protect customer trust.

Growing Demand for Digital Transformation

The software defined-perimeter market is being propelled by the accelerating pace of digital transformation across various sectors in South Korea. Organizations are increasingly adopting cloud-based services and digital solutions to enhance operational efficiency and customer engagement. This trend necessitates the implementation of secure access controls, which software defined-perimeter solutions provide. In 2025, it is anticipated that the digital transformation market in South Korea will reach $50 billion, with a substantial portion allocated to security solutions. As businesses strive to innovate and remain competitive, the software defined-perimeter market is likely to see significant growth, driven by the need for secure digital environments.