Rising Urbanization Trends

Spain is experiencing a notable trend of urbanization, with approximately 80% of its population residing in urban areas as of 2025. This shift creates a pressing need for smart city solutions to address challenges such as traffic congestion, waste management, and energy consumption. The smart city market is poised to benefit from this demographic change, as cities seek innovative technologies to enhance urban living. The demand for efficient public transport systems and sustainable energy solutions is likely to increase, driving investments in smart infrastructure. As urban areas continue to expand, the smart city market is expected to grow significantly, potentially reaching a valuation of €10 billion by 2030.

Public-Private Partnerships

Public-private partnerships (PPPs) are emerging as a vital mechanism for advancing the smart city market in Spain. These collaborations enable the pooling of resources and expertise from both sectors, facilitating the development of innovative solutions. As of November 2025, several successful PPP projects have been launched, focusing on areas such as smart transportation and energy management. The involvement of private companies brings in technological expertise and funding, while public entities provide regulatory support and infrastructure. This synergy is likely to accelerate the implementation of smart city initiatives, fostering a more integrated urban environment. The growth of PPPs may lead to a more dynamic smart city market, with increased opportunities for innovation and investment.

Environmental Sustainability Goals

Spain's commitment to environmental sustainability is a driving force behind the smart city market. The government has set ambitious targets to reduce greenhouse gas emissions by 55% by 2030, which necessitates the adoption of smart technologies. Initiatives such as smart waste management systems and energy-efficient buildings are gaining traction, as cities strive to meet these sustainability goals. The smart city market is expected to play a pivotal role in achieving these objectives, with investments in renewable energy sources and smart grids projected to exceed €5 billion by 2027. This focus on sustainability not only addresses environmental concerns but also enhances the overall livability of urban areas.

Government Initiatives and Funding

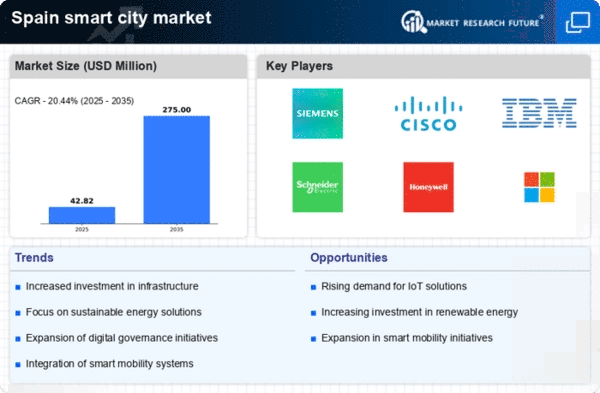

The Spanish government actively promotes the smart city market through various initiatives and funding programs. In recent years, substantial investments have been allocated to enhance urban infrastructure, with an estimated €1.5 billion earmarked for smart city projects by 2025. This financial support aims to foster innovation and improve public services, thereby driving the growth of the smart city market. Local governments are encouraged to adopt smart technologies, which can lead to increased efficiency in resource management and improved quality of life for citizens. The emphasis on digital transformation aligns with Spain's broader economic recovery strategy, suggesting a robust future for the smart city market in the region.

Technological Advancements in Communication

The rapid evolution of communication technologies, particularly 5G, is transforming the smart city market in Spain. The deployment of 5G networks facilitates real-time data exchange and enhances connectivity among various smart city applications. This technological advancement is crucial for the implementation of IoT devices, which are integral to smart city solutions. As of November 2025, it is estimated that 5G coverage will reach over 70% of urban areas in Spain, enabling cities to leverage data analytics for improved decision-making. The integration of advanced communication technologies is likely to accelerate the development of smart city projects, making them more efficient and responsive to citizens' needs.