Growing Cybersecurity Threats

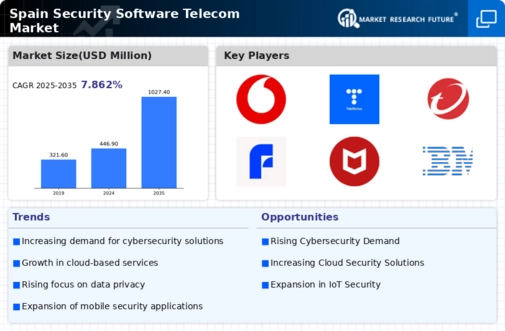

The Spain security software telecom market is currently experiencing a surge in cybersecurity threats, which is driving demand for robust security solutions. With the increasing sophistication of cyberattacks, organizations are compelled to invest in advanced security software to protect sensitive data and maintain operational integrity. According to recent data, cybercrime costs in Spain have escalated, prompting both public and private sectors to prioritize cybersecurity measures. This trend indicates a growing awareness of the need for comprehensive security frameworks, which in turn fuels the growth of the security software telecom market. As businesses seek to mitigate risks associated with data breaches and cyber threats, the demand for innovative security solutions is likely to continue rising, thereby shaping the future landscape of the Spain security software telecom market.

Government Initiatives and Support

The Spain security software telecom market benefits significantly from government initiatives aimed at enhancing national cybersecurity. The Spanish government has implemented various policies and frameworks to bolster the cybersecurity posture of organizations across sectors. For instance, the National Cybersecurity Strategy outlines measures to promote the adoption of security software solutions among telecom operators and other critical infrastructure providers. This governmental support not only encourages investment in security technologies but also fosters collaboration between public and private entities. As a result, the market is likely to witness increased growth driven by these initiatives, which aim to create a more secure digital environment in Spain. The proactive stance taken by the government suggests a commitment to strengthening the security software telecom market, thereby enhancing overall resilience against cyber threats.

Emergence of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices in Spain is significantly impacting the security software telecom market. As more devices become interconnected, the potential attack surface for cyber threats expands, necessitating enhanced security measures. Organizations are increasingly recognizing the importance of securing IoT ecosystems, which has led to a surge in demand for specialized security software solutions. Recent reports indicate that the number of connected devices in Spain is projected to grow exponentially, prompting businesses to invest in comprehensive security frameworks to safeguard their networks. This trend highlights the critical need for innovative security solutions that can address the unique challenges posed by IoT environments. Consequently, the emergence of IoT is likely to drive growth in the security software telecom market, as companies seek to protect their assets and maintain operational continuity.

Increased Focus on Data Privacy Regulations

The Spain security software telecom market is being shaped by an increased focus on data privacy regulations. With the implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt security software solutions that ensure compliance and protect personal data. This regulatory landscape has heightened awareness among businesses regarding the importance of data security, leading to a surge in demand for security software tailored to meet these requirements. Recent data suggests that companies in Spain are prioritizing investments in security technologies to avoid potential penalties associated with non-compliance. As organizations strive to align their practices with evolving data privacy regulations, the security software telecom market is likely to experience sustained growth, driven by the need for effective solutions that address both security and compliance challenges.

Rising Demand for Cloud-Based Security Solutions

The Spain security software telecom market is witnessing a notable shift towards cloud-based security solutions. As organizations increasingly migrate their operations to the cloud, the need for scalable and flexible security measures becomes paramount. Cloud security software offers numerous advantages, including cost-effectiveness and ease of deployment, which appeal to businesses of all sizes. Recent statistics indicate that cloud adoption in Spain has accelerated, with a significant percentage of companies prioritizing cloud security as part of their digital transformation strategies. This trend is likely to drive the growth of the security software telecom market, as providers develop innovative cloud-based solutions tailored to meet the evolving needs of customers. The increasing reliance on cloud infrastructure suggests that the demand for effective security measures will continue to rise, further shaping the landscape of the Spain security software telecom market.