Investment in Smart Infrastructure

Spain's commitment to developing smart infrastructure is significantly influencing the private lte market. The government has initiated various projects aimed at enhancing urban connectivity and integrating advanced technologies into public services. This investment is expected to create a favorable environment for the private lte market, as businesses and municipalities seek to leverage private networks for improved service delivery. The integration of IoT devices and smart sensors into urban planning necessitates a reliable communication backbone, which private lte networks can provide. As a result, the private lte market is likely to witness increased adoption in smart city projects, with an estimated market value reaching €1 billion by 2027, reflecting the growing importance of connectivity in urban development.

Enhanced Data Security Requirements

In an era where data breaches and cyber threats are prevalent, the private lte market in Spain is witnessing heightened demand for enhanced data security solutions. Organizations are increasingly aware of the vulnerabilities associated with public networks and are turning to private lte networks to safeguard sensitive information. The Private LTE Market offers advanced encryption and secure access controls, which are critical for industries such as healthcare and finance. As regulatory frameworks evolve to address data protection, businesses are likely to invest more in private lte solutions to comply with stringent security standards. This shift is expected to drive the private lte market's growth, with projections indicating a potential increase in market share by 20% over the next few years as organizations prioritize security in their communication strategies.

Support for Industry 4.0 Initiatives

The Private LTE Market in Spain is increasingly aligned with the objectives of Industry 4.0, which emphasizes automation, data exchange, and smart manufacturing. As industries transition towards more automated processes, the demand for reliable and high-speed communication networks becomes paramount. Private lte networks provide the necessary infrastructure to support the interconnectivity of machines and devices, facilitating real-time data analytics and decision-making. This alignment with Industry 4.0 initiatives is expected to propel the private lte market forward, with forecasts suggesting a market growth rate of 22% as companies invest in digital transformation. The integration of private lte solutions into manufacturing processes is likely to enhance productivity and innovation, positioning Spain as a leader in the adoption of advanced industrial technologies.

Rising Need for Operational Efficiency

The quest for operational efficiency is a driving force behind the growth of the private lte market in Spain. Companies are increasingly recognizing the value of private networks in streamlining operations and reducing costs. By implementing private lte solutions, organizations can achieve lower latency, higher bandwidth, and improved reliability, which are essential for mission-critical applications. Industries such as transportation and logistics are particularly focused on optimizing their supply chains through enhanced communication capabilities. The private lte market is thus positioned to benefit from this trend, with an anticipated market expansion of approximately 18% as businesses seek to leverage technology for competitive advantage. This emphasis on efficiency is likely to shape investment decisions in the coming years.

Growing Demand for Reliable Connectivity

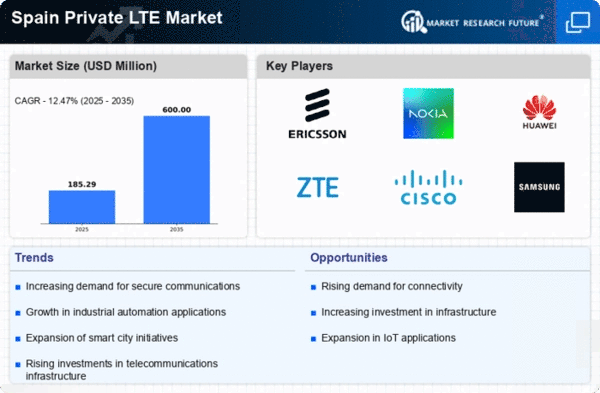

The private lte market in Spain is experiencing a surge in demand for reliable connectivity solutions across various sectors. Industries such as manufacturing, logistics, and energy are increasingly reliant on uninterrupted communication networks to enhance operational efficiency. This trend is underscored by the need for real-time data transmission and remote monitoring capabilities. According to recent estimates, the private lte market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the necessity for robust and secure communication infrastructures. As businesses seek to optimize their processes, the private lte market is positioned to play a pivotal role in facilitating seamless connectivity, thereby supporting the digital transformation initiatives of enterprises throughout Spain.