Growing Geriatric Population

Spain's aging population is a significant driver for the polysomnography devices market. As individuals age, the likelihood of developing sleep disorders increases, necessitating effective diagnostic tools. By 2030, it is projected that over 20% of Spain's population will be aged 65 and older, creating a substantial demand for polysomnography devices. This demographic shift is prompting healthcare providers to enhance their sleep disorder management capabilities, thereby driving market growth. Furthermore, the elderly population is more likely to seek medical attention for sleep-related issues, which could lead to an increase in polysomnography tests. Consequently, the market is expected to expand as healthcare systems adapt to meet the needs of this growing demographic.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in Spain are playing a crucial role in the polysomnography devices market. Increased funding for sleep disorder research and the establishment of specialized sleep clinics are encouraging the adoption of advanced polysomnography devices. The Spanish government has allocated substantial resources to enhance diagnostic capabilities in healthcare facilities, which is expected to boost the market. Additionally, public health campaigns focusing on the importance of sleep health are raising awareness among the population, leading to higher demand for diagnostic services. This supportive environment is likely to foster growth in the polysomnography devices market, as more healthcare providers invest in state-of-the-art equipment.

Rising Incidence of Sleep Disorders

The increasing prevalence of sleep disorders in Spain is a primary driver for the polysomnography devices market. Conditions such as sleep apnea, insomnia, and restless leg syndrome are becoming more common, affecting a significant portion of the population. Recent studies indicate that approximately 30% of adults in Spain experience some form of sleep disturbance, which necessitates the use of polysomnography devices for accurate diagnosis and treatment. This growing patient base is likely to propel demand for advanced polysomnography devices, as healthcare providers seek effective solutions to manage these conditions. Furthermore, the awareness of the health implications associated with untreated sleep disorders is prompting more individuals to seek medical advice, thereby increasing the market's growth potential.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in Spain is influencing the polysomnography devices market. As healthcare providers and patients alike recognize the importance of early diagnosis and intervention for sleep disorders, there is a growing demand for polysomnography devices. Preventive measures can significantly reduce the long-term health risks associated with untreated sleep conditions, such as cardiovascular diseases and diabetes. This trend is reflected in the increasing number of sleep studies being conducted in both clinical and home settings. The market is likely to benefit from this focus on prevention, as more individuals seek out diagnostic services to address potential sleep issues before they escalate. This proactive approach to health management is expected to drive growth in the polysomnography devices market.

Technological Innovations in Sleep Monitoring

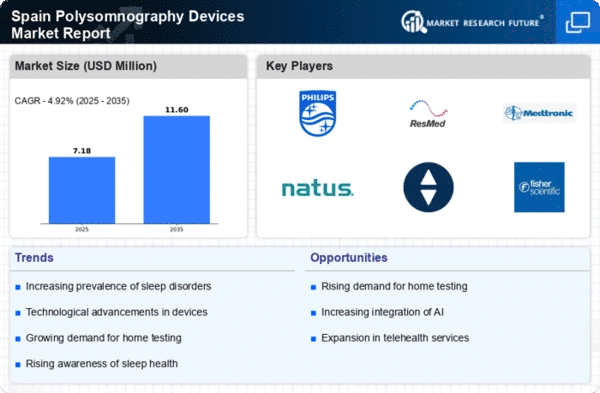

Technological advancements in sleep monitoring are significantly influencing the polysomnography devices market. Innovations such as portable sleep monitors, wearable devices, and advanced software algorithms are enhancing the accuracy and convenience of sleep studies. In Spain, the integration of artificial intelligence and machine learning in polysomnography devices is expected to improve diagnostic capabilities, leading to better patient outcomes. The market for these devices is projected to grow at a CAGR of around 8% over the next five years, driven by the demand for more efficient and user-friendly solutions. As healthcare providers adopt these technologies, the polysomnography devices market is likely to expand, catering to both clinical and home-based sleep studies.