Increased Healthcare Expenditure

The upward trend in healthcare expenditure in the United States is positively influencing the polysomnography devices market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing allocation of funds towards advanced diagnostic technologies. This financial commitment enables healthcare facilities to invest in state-of-the-art polysomnography devices, enhancing their diagnostic capabilities. Furthermore, increased reimbursement rates for sleep studies by insurance providers encourage more healthcare practitioners to utilize these devices. As a result, the polysomnography devices market is likely to expand, driven by the need for improved diagnostic accuracy and patient care.

Growing Awareness of Sleep Health

There is a notable increase in public awareness regarding the importance of sleep health, which is significantly impacting the polysomnography devices market. Campaigns promoting the understanding of sleep disorders and their effects on overall health have led to more individuals seeking medical advice. This heightened awareness is driving demand for polysomnography devices, as patients are more inclined to undergo sleep studies for accurate diagnosis. Additionally, healthcare professionals are emphasizing the need for proper sleep assessments, further propelling the market. The polysomnography devices market is thus positioned for growth as more individuals recognize the critical role of sleep in maintaining health.

Rising Prevalence of Sleep Disorders

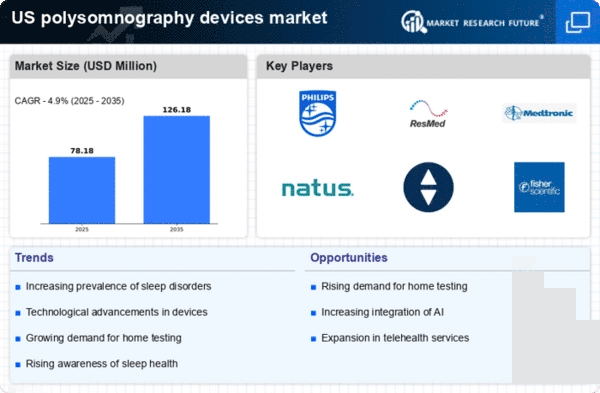

The increasing incidence of sleep disorders, such as sleep apnea, insomnia, and restless leg syndrome, is a primary driver for the polysomnography devices market. According to recent estimates, approximately 22 million Americans suffer from sleep apnea alone, highlighting a significant demand for effective diagnostic tools. This growing prevalence necessitates advanced polysomnography devices to facilitate accurate diagnosis and treatment. As awareness of sleep disorders rises, healthcare providers are increasingly adopting these devices to improve patient outcomes. The polysomnography devices market is expected to experience substantial growth as more individuals seek diagnosis and treatment options, thereby driving innovation and investment in this sector.

Technological Integration in Healthcare

The integration of advanced technologies, such as artificial intelligence and telemedicine, into healthcare is transforming the polysomnography devices market. These innovations enhance the functionality and efficiency of polysomnography devices, allowing for remote monitoring and data analysis. For instance, AI algorithms can analyze sleep patterns more accurately, leading to better diagnostic outcomes. The adoption of telemedicine facilitates access to sleep studies, particularly for patients in remote areas. As healthcare systems increasingly embrace these technologies, the polysomnography devices market is likely to witness significant advancements, improving patient care and operational efficiency.

Regulatory Support for Sleep Disorder Treatments

Regulatory bodies in the United States are increasingly supporting the development and approval of devices for sleep disorder treatments, which is beneficial for the polysomnography devices market. Initiatives aimed at expediting the approval process for innovative diagnostic tools encourage manufacturers to invest in research and development. This regulatory support not only fosters innovation but also ensures that patients have access to the latest technologies for sleep assessment. As a result, the polysomnography devices market is expected to grow, driven by a favorable regulatory environment that promotes the introduction of advanced diagnostic solutions.