Consumer Awareness and Education

The growing awareness among consumers regarding health and wellness is influencing the point of-care-molecular-diagnostics market in Spain. As individuals become more informed about the benefits of early diagnosis and treatment, there is an increasing demand for accessible testing options. Educational campaigns by health organizations are promoting the importance of regular health check-ups and the role of molecular diagnostics in preventive care. This shift in consumer behavior is expected to drive market growth, as more people seek out point-of-care testing solutions. Surveys indicate that approximately 30% of the population is now more likely to utilize diagnostic services, reflecting a significant change in attitudes towards health management.

Growing Focus on Personalized Medicine

The shift towards personalized medicine in Spain is significantly influencing the point of-care-molecular-diagnostics market. As healthcare providers increasingly recognize the importance of tailored treatment plans, molecular diagnostics play a pivotal role in identifying specific patient needs. This approach not only improves treatment efficacy but also minimizes adverse effects. The market is projected to grow as more healthcare institutions adopt molecular testing to guide therapeutic decisions. In fact, the Spanish healthcare sector has seen a 20% increase in the adoption of personalized medicine strategies, which correlates with a rising demand for point-of-care diagnostics that can deliver rapid and accurate results.

Technological Integration in Healthcare

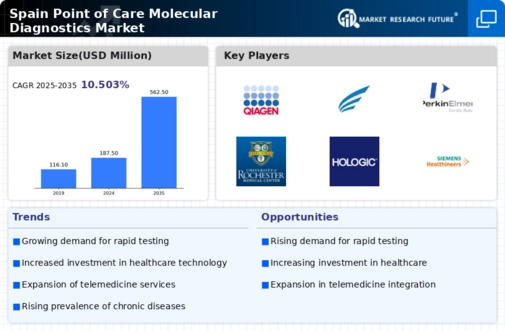

The integration of advanced technologies in healthcare is propelling the point of-care-molecular-diagnostics market forward in Spain. Innovations such as artificial intelligence and machine learning are enhancing the accuracy and speed of diagnostic tests. These technologies enable healthcare professionals to interpret results more effectively, leading to quicker clinical decisions. Furthermore, the Spanish government has been investing in digital health initiatives, which are expected to increase the accessibility of point-of-care testing. As a result, the market is anticipated to expand, with a projected growth rate of 10% annually over the next five years, driven by the demand for more efficient and reliable diagnostic solutions.

Rising Prevalence of Infectious Diseases

The increasing incidence of infectious diseases in Spain is a crucial driver for the point of-care-molecular-diagnostics market. With a reported rise in conditions such as respiratory infections and sexually transmitted diseases, healthcare providers are seeking rapid diagnostic solutions. The Spanish healthcare system is under pressure to deliver timely results, which point-of-care testing can facilitate. According to recent health statistics, the prevalence of certain infectious diseases has surged by approximately 15% over the past few years. This trend underscores the necessity for efficient diagnostic tools that can be deployed in various settings, including clinics and emergency rooms, thereby enhancing patient outcomes and reducing the burden on healthcare facilities.

Increased Investment in Healthcare Infrastructure

The Spanish government's commitment to improving healthcare infrastructure is a significant driver for the point of-care-molecular-diagnostics market. Recent investments aimed at modernizing healthcare facilities and expanding access to diagnostic services are likely to enhance the availability of point-of-care testing. This initiative aligns with the broader goal of improving public health outcomes and reducing healthcare disparities. With an estimated €1 billion allocated for healthcare upgrades, the market is poised for growth as more facilities adopt molecular diagnostics. This investment not only supports the development of new technologies but also ensures that healthcare providers can meet the rising demand for rapid and accurate testing.