Rising Demand for Rapid Diagnostics

The increasing need for rapid diagnostic solutions is a key driver in the point of-care-molecular-diagnostics market. Healthcare providers in France are increasingly prioritizing quick and accurate testing to enhance patient outcomes. This demand is particularly pronounced in emergency care settings, where timely diagnosis can significantly influence treatment decisions. The market is projected to grow at a CAGR of approximately 10% over the next five years, reflecting the urgency for rapid testing solutions. Furthermore, the rise in chronic diseases necessitates frequent monitoring, further fueling the demand for point-of-care diagnostics. As healthcare systems evolve, the integration of these technologies into routine practice appears to be a strategic priority, thereby driving market growth.

Focus on Infectious Disease Management

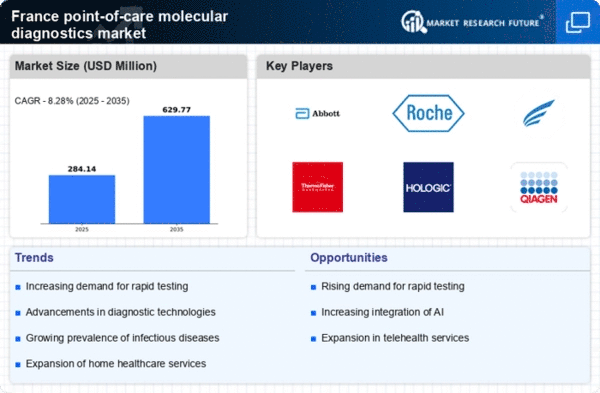

The emphasis on managing infectious diseases is a critical driver in the point of-care-molecular-diagnostics market. France has been proactive in addressing public health challenges related to infectious diseases, leading to increased funding and resources allocated to diagnostic solutions. The market is projected to grow by 8% annually, reflecting the heightened focus on early detection and management of infectious diseases. Point-of-care molecular diagnostics play a pivotal role in this strategy, enabling rapid identification of pathogens and facilitating timely treatment. As healthcare policies continue to prioritize infectious disease management, the demand for effective diagnostic tools is likely to surge, thereby propelling market growth.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare practices is a notable driver for the point of-care-molecular-diagnostics market. In France, the adoption of digital health solutions, including telemedicine and mobile health applications, is transforming how diagnostics are conducted. This technological shift facilitates the use of point-of-care testing devices, allowing for real-time data collection and analysis. The market is expected to witness a growth rate of approximately 9% as healthcare providers increasingly leverage technology to enhance diagnostic accuracy and efficiency. Moreover, the synergy between technology and diagnostics is likely to improve patient engagement and adherence to treatment protocols, further driving the market forward.

Growing Awareness of Personalized Medicine

The shift towards personalized medicine is emerging as a crucial driver in the point of-care-molecular-diagnostics market. In France, there is a growing recognition of the importance of tailored treatment approaches based on individual patient profiles. This trend is leading to an increased demand for molecular diagnostics that can provide specific insights into a patient's condition. The market for personalized medicine is anticipated to expand significantly, with projections indicating a growth rate of around 12% annually. As healthcare providers seek to implement more individualized treatment plans, the role of point-of-care diagnostics becomes increasingly vital. This evolution in treatment paradigms is likely to enhance the adoption of molecular diagnostics, thereby propelling market growth.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in France is a significant driver for the point of-care-molecular-diagnostics market. The French government has been actively enhancing healthcare facilities, which includes the adoption of advanced diagnostic technologies. This investment is expected to reach €2 billion by 2026, focusing on improving access to healthcare services. Enhanced infrastructure facilitates the deployment of point-of-care testing devices, making them more accessible to patients. Additionally, the emphasis on modernizing laboratories and healthcare facilities supports the integration of molecular diagnostics into everyday clinical practice. As a result, the market is likely to experience substantial growth, driven by improved healthcare access and the availability of advanced diagnostic tools.