Shifting Consumer Preferences

Consumer preferences in Spain are evolving, with a noticeable shift towards on-demand content consumption. The over-the-top-content market is witnessing a growing demand for flexibility and personalization in viewing experiences. Spanish consumers increasingly favor subscription-based models that allow them to access a wide array of content without traditional cable constraints. This trend is reflected in the rising number of OTT subscriptions, which reached approximately 15 million in 2025, indicating a robust market presence. Furthermore, the desire for localized content, including Spanish-language films and series, enhances the appeal of OTT platforms, as they cater to the unique tastes of the audience. This shift in consumer behavior suggests that the over-the-top-content market will continue to expand as providers adapt to these changing preferences.

Increasing Internet Penetration

The expansion of internet access in Spain plays a crucial role in the growth of the over-the-top-content market. As of November 2025, approximately 90% of households have internet connectivity, which facilitates the consumption of streaming services. This high penetration rate indicates a favorable environment for OTT platforms to thrive. Moreover, the increasing availability of high-speed broadband and mobile data services enhances user experience, allowing for seamless streaming. The over-the-top-content market benefits from this trend, as more users gain access to diverse content offerings. Additionally, the rise of smart devices, such as smartphones and smart TVs, further supports the consumption of OTT services, potentially leading to increased subscription rates and viewer engagement.

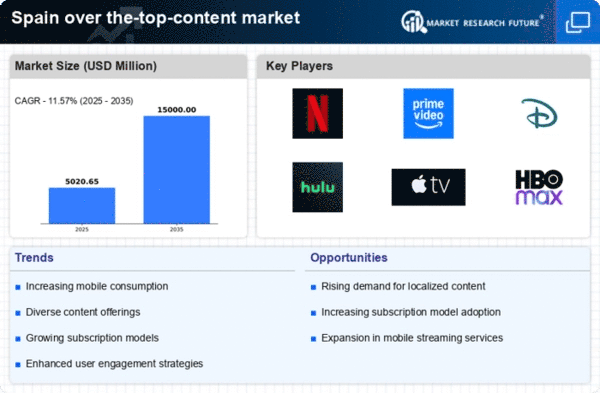

Competitive Landscape and Market Entry

The competitive dynamics within the over-the-top-content market in Spain are intensifying, with both established players and new entrants vying for market share. Major international platforms, such as Netflix and Amazon Prime Video, are increasingly investing in localized content to attract Spanish viewers. Simultaneously, local providers are emerging, offering tailored content that resonates with regional audiences. This competitive landscape fosters innovation and drives improvements in service quality, which may lead to enhanced user satisfaction. As of November 2025, the market is projected to grow at a CAGR of approximately 12%, driven by this competitive environment. The influx of new services and content offerings indicates a vibrant market, suggesting that consumers will benefit from a wider selection of choices.

Technological Advancements in Streaming

Technological innovations are significantly influencing the over-the-top-content market in Spain. The advent of advanced streaming technologies, such as 4K and HDR, enhances the viewing experience, making OTT services more appealing to consumers. As of November 2025, a growing % of households are equipped with compatible devices, which may lead to increased demand for high-quality content. Additionally, the integration of artificial intelligence and machine learning in content recommendation systems is likely to improve user engagement by providing personalized viewing suggestions. These technological advancements not only enhance the overall user experience but also position OTT platforms as competitive alternatives to traditional broadcasting. The ongoing evolution of technology suggests that the over-the-top-content market will continue to adapt and thrive in the coming years.

Regulatory Environment and Content Policies

The regulatory framework governing the over-the-top-content market in Spain is evolving, impacting how services operate and compete. Recent policies aimed at promoting local content production and distribution are likely to shape the market landscape. For instance, regulations may require OTT platforms to allocate a certain % of their catalog to Spanish-language content, thereby encouraging the development of local talent and productions. This regulatory push not only supports the cultural identity of Spain but also enhances the attractiveness of OTT services for consumers seeking relatable content. As the regulatory environment continues to adapt, it may create both challenges and opportunities for market players, influencing their strategies and content offerings.