Increased Focus on Data Security

As data breaches and cyber threats become more prevalent, the optical character-recognition market is experiencing heightened scrutiny regarding data security measures. Organizations in Spain are increasingly prioritizing the protection of sensitive information processed through OCR systems. This focus on security is driving the development of advanced encryption and authentication technologies within the optical character-recognition market. Companies are likely to invest in solutions that not only enhance OCR capabilities but also ensure compliance with stringent data protection regulations. The market is expected to evolve as businesses seek to balance efficiency with security, potentially leading to the emergence of new standards and practices in the industry.

Expansion of E-Government Services

The expansion of e-government services in Spain is creating new opportunities for the optical character-recognition market. Government agencies are increasingly adopting OCR technology to streamline processes such as document verification and citizen service delivery. This trend is likely to enhance operational efficiency and improve public service accessibility. As e-government initiatives continue to grow, the demand for reliable OCR solutions is expected to rise. Recent reports suggest that the Spanish government is investing heavily in digital transformation, with a projected budget of €1 billion allocated for technology upgrades over the next three years. This investment is likely to bolster the optical character-recognition market as agencies seek to modernize their operations.

Growing Adoption of AI Technologies

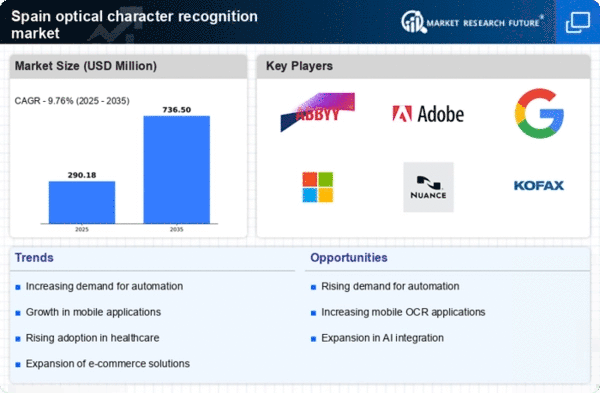

The integration of artificial intelligence (AI) technologies into the optical character-recognition market is driving substantial growth in Spain. Businesses are increasingly leveraging AI to enhance the accuracy and efficiency of OCR systems. This trend is evident in sectors such as finance and healthcare, where the need for precise data extraction is paramount. According to recent estimates, the OCR market in Spain is projected to grow at a CAGR of approximately 15% over the next five years. The ability of AI to learn from data and improve over time is likely to make OCR solutions more appealing to organizations seeking to streamline operations and reduce manual data entry. As AI continues to evolve, its impact on the optical character-recognition market is expected to deepen, potentially leading to innovative applications and improved user experiences.

Emergence of Mobile OCR Applications

The rise of mobile technology is significantly impacting the optical character-recognition market in Spain. With the increasing use of smartphones and tablets, mobile OCR applications are becoming more prevalent, allowing users to capture and convert text from images on-the-go. This trend is particularly appealing to small businesses and freelancers who require flexible and efficient solutions for document management. The optical character-recognition market is likely to benefit from the growing demand for mobile applications that offer user-friendly interfaces and robust functionality. Market analysts project that the mobile OCR segment could account for over 30% of the overall market share by 2027, indicating a shift towards more accessible and versatile OCR solutions.

Rising Demand for Document Digitization

The push for document digitization across various industries in Spain is significantly influencing the optical character-recognition market. Organizations are increasingly recognizing the benefits of converting physical documents into digital formats, which enhances accessibility and storage efficiency. This trend is particularly pronounced in sectors such as legal and education, where vast amounts of paperwork are commonplace. The optical character-recognition market is expected to see a surge in demand as businesses seek to automate their document management processes. Recent data indicates that the market for document digitization solutions in Spain is anticipated to reach €500 million by 2026, reflecting a growing recognition of the importance of OCR technology in facilitating seamless information retrieval and management.