Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices significantly influences the network telemetry market in Spain. As more devices connect to networks, the complexity of data management increases, necessitating robust telemetry solutions. The number of connected IoT devices in Spain is expected to reach 50 million by 2026, creating a pressing need for effective monitoring and analysis tools. This expansion drives organizations to adopt network telemetry solutions that can handle vast amounts of data generated by these devices. Consequently, the network telemetry market is likely to witness substantial growth as businesses strive to optimize their IoT ecosystems.

Increased Cybersecurity Concerns

Cybersecurity remains a critical concern for organizations in Spain, propelling the network telemetry market forward. With the rise in cyber threats, businesses are prioritizing the implementation of telemetry solutions to enhance their security posture. Network telemetry provides valuable insights into traffic patterns and potential vulnerabilities, enabling organizations to detect and respond to threats more effectively. Recent statistics indicate that cyberattacks in Spain have increased by 30% in the past year, underscoring the urgency for robust security measures. As a result, the network telemetry market is likely to expand as companies invest in advanced monitoring tools to safeguard their networks.

Regulatory Compliance Requirements

the network telemetry market in Spain is greatly influenced by stringent regulatory compliance requirements. Organizations must adhere to various data protection regulations, such as the General Data Protection Regulation (GDPR). These regulations necessitate the implementation of telemetry solutions that ensure data integrity and security. Companies are increasingly adopting network telemetry tools to monitor compliance and mitigate risks associated with data breaches. The market is expected to grow as businesses recognize the importance of maintaining compliance while optimizing their network performance. This driver highlights the intersection of regulatory demands and technological advancements within the network telemetry market.

Rising Demand for Real-Time Data Analysis

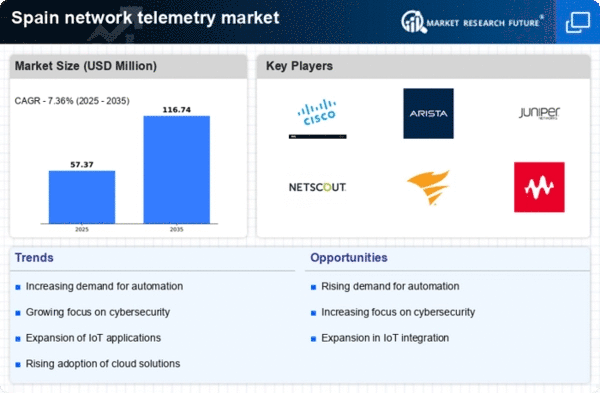

the network telemetry market in Spain is seeing a significant increase in demand for real-time data analysis. Organizations increasingly recognize the value of immediate insights for decision-making processes. This trend is driven by the need for enhanced operational efficiency and proactive issue resolution. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. Companies are investing in advanced telemetry solutions to monitor network performance continuously, enabling them to respond swiftly to anomalies. This shift towards real-time analytics is reshaping the network telemetry market, as businesses seek to leverage data for competitive advantage.

Shift Towards Automation in Network Management

The trend towards automation in network management is reshaping the network telemetry market in Spain. Organizations are increasingly adopting automated solutions to streamline their network operations, reduce human error, and enhance efficiency. Automation tools integrated with telemetry solutions allow for real-time monitoring and management of network performance. This shift is expected to drive market growth, as businesses seek to optimize resource allocation and improve service delivery. The network telemetry market is likely to benefit from this trend, with companies investing in technologies that facilitate automated responses to network issues, thereby enhancing overall operational effectiveness.