Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices in Spain is significantly influencing the network automation market. As more devices connect to networks, the complexity of managing these connections increases. This complexity necessitates advanced automation solutions to ensure seamless integration and management of IoT devices. Recent estimates suggest that the number of connected IoT devices in Spain could reach 50 million by 2026, creating a pressing need for robust network automation strategies. The network automation market is responding to this demand by developing solutions that enhance scalability and reliability. Companies are investing in automation tools that can efficiently handle the influx of data generated by IoT devices, thereby improving network performance and security. This integration is expected to drive substantial growth in the network automation market as organizations seek to harness the full potential of IoT technologies.

Focus on Enhanced Network Security

The growing concern over network security threats is a critical driver for the network automation market in Spain. Organizations are increasingly aware of the vulnerabilities associated with traditional network management practices. As cyber threats become more sophisticated, there is a pressing need for automated security solutions that can proactively identify and mitigate risks. The network automation market is witnessing a surge in demand for tools that integrate security features into network management processes. Companies are investing in automation technologies that provide real-time threat detection and response capabilities, thereby enhancing their overall security posture. This focus on security is likely to drive further innovation and investment in the network automation market, as organizations prioritize the protection of their digital assets.

Regulatory Compliance and Data Privacy

In Spain, the increasing emphasis on regulatory compliance and data privacy is shaping the network automation market. Organizations are compelled to adhere to stringent regulations such as the General Data Protection Regulation (GDPR), which mandates robust data protection measures. This regulatory landscape is driving the adoption of network automation solutions that facilitate compliance through automated monitoring and reporting. The network automation market is witnessing a rise in demand for tools that can ensure data integrity and security while minimizing the risk of non-compliance penalties. Companies are investing in automation technologies that not only streamline compliance processes but also enhance overall network security. This focus on regulatory adherence is likely to propel growth in the network automation market as businesses prioritize data protection and risk management.

Rising Demand for Operational Efficiency

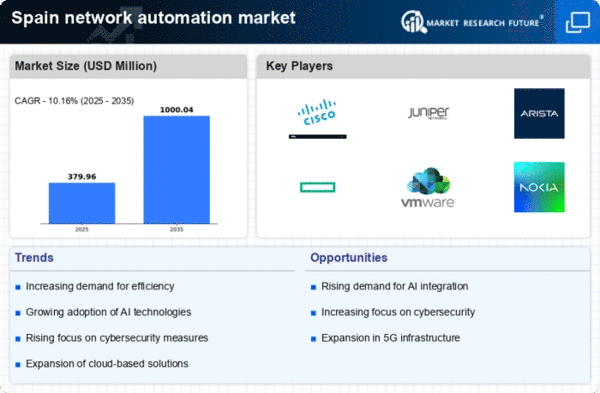

The network automation market in Spain is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their network operations to reduce costs and enhance productivity. According to recent data, companies that implement network automation solutions can achieve up to 30% reduction in operational expenses. This trend is driven by the desire to minimize human error and optimize resource allocation. As businesses strive to remain competitive, the adoption of automated solutions is becoming a strategic imperative. The network automation market is thus witnessing a shift towards technologies that facilitate real-time monitoring and management, enabling organizations to respond swiftly to network issues. This focus on efficiency is likely to propel further investments in automation technologies, fostering innovation and growth within the sector.

Shift Towards Hybrid Network Architectures

The transition towards hybrid network architectures is a significant driver in the network automation market in Spain. Organizations are increasingly adopting a combination of on-premises and cloud-based solutions to enhance flexibility and scalability. This shift necessitates advanced automation tools to manage the complexities associated with hybrid environments. The network automation market is responding by offering solutions that enable seamless integration and management of diverse network components. As businesses seek to optimize their network performance, the demand for automation technologies that can facilitate this hybrid approach is likely to grow. Recent surveys indicate that over 60% of Spanish companies are planning to implement hybrid network strategies in the coming years, further underscoring the importance of automation in this evolving landscape.