Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are driving the monochrome display market in Spain, particularly in industries such as healthcare and manufacturing. The need for clear and reliable displays that meet stringent safety regulations is paramount. Monochrome displays are often favored for their simplicity and ease of use, which aligns with compliance requirements. The healthcare sector, for instance, is increasingly utilizing monochrome displays for medical devices, where clarity can be a matter of life and death. As regulations become more stringent, the monochrome display market is likely to see increased demand as companies seek to ensure compliance while maintaining operational efficiency.

Technological Advancements in Display Technology

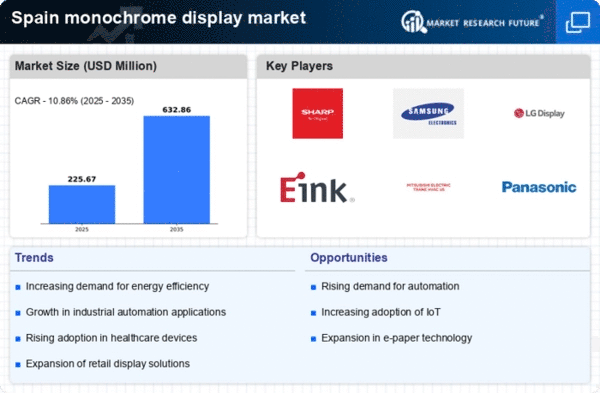

The monochrome display market is experiencing a surge in demand due to rapid technological advancements. Innovations in LCD and OLED technologies have enhanced the performance and reliability of monochrome displays, making them more appealing for various applications. In Spain, the market is projected to grow at a CAGR of 5.2% from 2025 to 2030, driven by the increasing adoption of these advanced technologies. The integration of high-resolution displays with improved contrast ratios has made monochrome displays suitable for sectors such as healthcare and industrial automation. As companies seek to upgrade their systems, the market is likely to benefit from this trend, as businesses prioritize quality and efficiency.

Growing Demand in Retail and Point of Sale Systems

The retail sector in Spain is witnessing a growing demand for monochrome displays, particularly in point of sale (POS) systems. Retailers are increasingly adopting these displays for their simplicity and cost-effectiveness. The monochrome display market is projected to capture a significant share of the POS market, which is expected to reach €1.5 billion by 2026. The clarity and readability of monochrome displays make them ideal for displaying transaction details and promotional information. Furthermore, the low power consumption of these displays aligns with the retail industry's focus on reducing operational costs. As a result, the monochrome display market is likely to see substantial growth as retailers continue to modernize their systems.

Increased Adoption in Transportation and Logistics

The transportation and logistics sectors in Spain are increasingly adopting monochrome displays for various applications, including vehicle dashboards and logistics management systems. The monochrome display market is benefiting from the need for reliable and easy-to-read information in high-stress environments. With the logistics market projected to grow by 4.5% annually, the demand for monochrome displays is expected to rise correspondingly. These displays provide essential information such as speed, fuel levels, and navigation data in a clear format, which is crucial for safety and efficiency. As the transportation sector continues to evolve, the monochrome display market is likely to play a pivotal role in enhancing operational effectiveness.

Cost-Effectiveness and Low Maintenance Requirements

Cost-effectiveness and low maintenance requirements are significant drivers for the monochrome display market in Spain. Businesses are increasingly looking for solutions that minimize operational costs while providing reliable performance. Monochrome displays are generally less expensive to produce and maintain compared to their color counterparts, making them an attractive option for various applications. The monochrome display market is expected to grow as companies prioritize budget-friendly solutions without compromising on quality. This trend is particularly evident in sectors such as manufacturing and logistics, where operational efficiency is crucial. As organizations continue to seek cost-effective technologies, the monochrome display market is likely to thrive.